Event Title: The launch of our Emerj AI in Banking Vendor Scorecard and Capability Map 2019 report

Date: June 17, 2019

What Happened

We set out on an ambitious project to answer four key questions at the intersection of AI in banking:

- What artificial intelligence (AI) applications and use-cases are delivering ROI now for the banking industry at banks like HSBC and Lloyd’s Banking Group?

- How are back-end banking processes (lending, fraud) and front-end processes (customer service, sales) being transformed or automated at large companies today?

- Which AI applications will define the winners and the losers in the banking industry in the next 5 years?

- Who are the leading AI vendors serving the banking industry? What are the strengths, weaknesses and case implementations for each of these vendors?

Most of our research work is one-to-one with enterprises and large organizations that want to unearth unique insights about the landscape of artificial intelligence possibilities in their sector. They want to be able to make better investments, develop the right technology, and take advantage of the technologies that are delivering value.

In much of our work, we assess the landscape of AI companies within a given space or sector and segment these companies into different business functions and unique AI capabilities that are now being enabled in that function. Determining these capabilities is an art form in and of itself, and its something we’ve gotten very good at by analyzing hundreds and hundreds of AI vendors across various sectors.

This is ultimately what clients are looking to pay for:

They don’t just want to know what’s possible; they want to know what’s working.

We have methods to help companies determine which applications have the most evidence of ROI, which are likely to be the easiest to deploy, and which are going to be the most challenging and expensive to deploy. We also can get a sense of which applications have yet to gain traction in the enterprise. These insights help companies select the right vendors, decide whether they should build or buy AI solutions, and invest in areas that are most likely to drive returns for their company.

Earlier this year, we decided that we should take these same methods and come up with a report that we could offer to our audience broadly.

Our work with companies is highly individualized, but we wanted to deliver our methods of cutting through the AI hype in a syndicated report that any of our readers could buy. Because we have more readers in the financial sector than any other sector, we decided to focus our first report on banking.

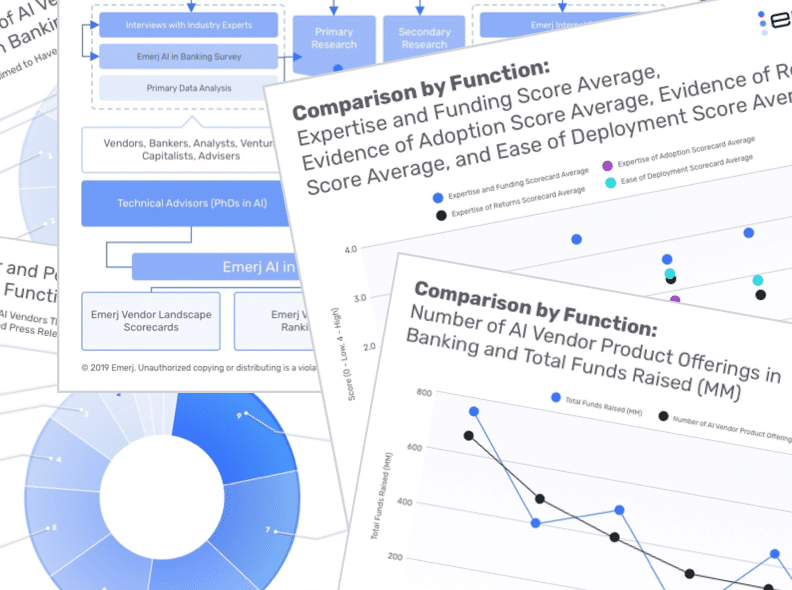

Here’s what went into the full report:

- We analyzed over 70 AI vendor solutions, including established like Ayasdi, ZestFinance – enterprises like IBM and SAS, and less established banking AI startups

- We mapped banking AI vendor solutions across 21 data points, including their total funds raised, headquarters location, and our proprietary Emerj Scores, including Evidence of ROI, Ease of Deployment, and more

- We analyzed over 40 internal banking use-cases at top banks like HSBC, Santander, and more

- We mapped internal AI use-cases at large banks across 6 data points, including AI capability, business function, and our proprietary Emerj Score: Stated Use-Case Maturity

- We distilled the AI in banking vendor landscape into distinct ontologies of AI capabilities and business functions within banking with help from our banking research advisors, including senior leaders from HSBC, Citigroup, and VISA, and our PhD technical advisors

- We interviewed dozens of leaders within banks, banking analysts, and B2B AI banking vendor leaders about the most critical trends and challenges

- We put the report together in 80 pages, including a dozen charts and graphs, and full access to the original data to be “sliced and diced” by our clients

We were fortunate to have research advisors on this project who are senior leaders at HSBC, Citibank, and Visa, each of whom have layered their insights on top of our dozens of interviews and months of our research on the AI landscape in banking.

What We Learned

You can listen to a breakdown of some of the critical insights from the report in the audio below:

Two points among the dozens of insights within the report jumped out at us immediately:

1 – Chatbots are Overhyped:

- Conversational interfaces are the focus of over 35% of the AI-related press releases from top 100 banks, but they represent only 8% of the total funding received by AI vendors selling into banking. Banks are incentivized to appear modern and convenient to their customers and investors. As a result, many banks believe the hype and do their own ill-fated chatbot pilot. This is due in part to what we call the “Lens of Incentives,” a dynamic in which companies heavily publicize and play up their use of AI for some business functions and conceal and downplay their use of AI for other business functions. This generally manifests itself as banks publishing press releases for their customer-facing AI applications, such as chatbots, and saying very little if anything about their risk-related AI applications, such as compliance automation.

- Transferrable Lesson: Ignore the PR Hype

- Enterprises typically announce AI projects only when they are in the company’s best interests to reveal. Ask yourself: What kinds of AI use-cases would make customers and investors most likely to feel good about this enterprise?It’s likely that the enterprise is exaggerating the applications that it thinks look good, and is downplaying AI applications that don’t. In banking, this means that chatbots are hyped and overblown in banking press releases, when in reality – compliance and fraud is where much of the traction is today. This same “lens” can be applied to thinking about the landscape of enterprise communications in your own sector.

- Transferrable Lesson: Ignore the PR Hype

2 – Banks are Focused on Risk, Not Efficiencies:

- Of the nearly $3 billion raised by AI vendors selling into banking, well over 50% was raised by vendors selling products for fraud and cybersecurity, compliance, risk management, and lending. Our interviews with banking experts confirmed that banks want to automate tedious and repetitive tasks and ensure safety from increased regulatory standards.

- Transferrable Lesson: Progress Occurs Where There’s IT Teams, IT Budget, Automation Effort

- After analyzing the entirety of the AI applications in banking – it became clear that adoption is easiest in business functions or processes that already have strong IT teams, IT budgets, and automation efforts.In banking this ties to the differences between functions like compliance and fraud – vs. functions like customer service. In your sector this might be different, but the same concept is important to keep in mind. The bigger the enterprise, the more this rule holds true.

- Transferrable Lesson: Progress Occurs Where There’s IT Teams, IT Budget, Automation Effort

Our Latest Newsletter – The Emerj AI in Banking Pulse

We’ve also launched our AI in Banking Pulse newsletter. Subscribers to the AI in Banking Pulse will receive insights on the state of AI in banking, including statistics, charts, and graphs from our paid reports – and our latest AI in Banking Podcast episodes delivered weekly.

Special Thanks

We wanted to give a special thanks to the banking experts, AI vendor executives, and venture capitalists we interviewed during our research:

Emerj Research Advisors:

- Ian Wilson: Former Head of Artificial Intelligence at HSBC

- Lee Smallwood: COO Markets and Securities Services North America at Citi

- Nishant Chandra: Senior Director of Data Products at Visa

Survey Respondents and Interviewees – Partial List:

- Ayasdi

- European Banking Federation

- FirstRand Group

- Flybits

- Women in Technology Venture Fund at BDC

- Carrick Capital Partners

- Ensemble Capital

- Flint Capital

- Sigmoidal

- AlgoDynamix

- CogniCor

- Datavisor

- Eigen Tech

- Heliocor

- Kasisto

- RiskIQ

- Thetaray

- TrueAccord

Header Image Credit: Citibank