Just as car companies are betting big that self-driving vehicles will change our roads, shipping companies are making a similar bet that automation will change how we move goods around the world. For autonomous ships, the open ocean may prove to be more fertile ground for the adoption of full automation than crowded city streets.

To understand where autonomous cargo shipping currently stands, where it is likely to go in the coming years, and what impact it will have, it is important to consider three major questions:

- What value can unmanned shipping provide to make it worth the heavy investment to change the industry?

- How does the industry plan to deploy these new autonomous shipping vessels?

- When do the major shipping companies and ship manufacturers expect automated ships to be in widespread use?

This article will examine the official predictions from several major players in the industry about how soon they expect to see autonomous ships, as well as both internal and external analyses of just how significantly they will change the industry and world commerce. By next year the first ship designed to be autonomous is set start plying the waters in Norway.

Before delving into the timeline estimates of autonomous boats from leading ship-building brands, we’ll take a look at the underlying economic and safety factors most likely to drive adoption of this technology:

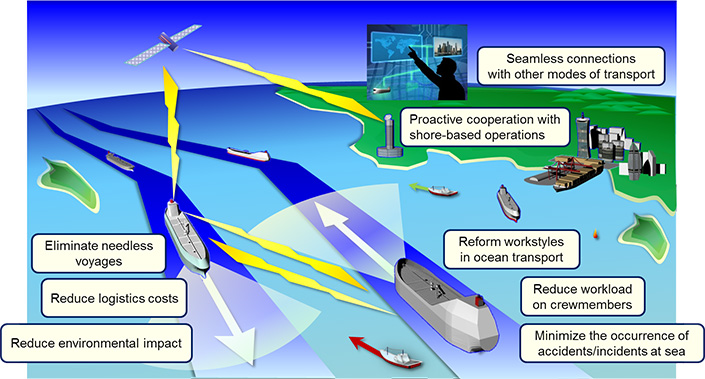

The Benefits of Autonomous Ships

Last year Mikael Makinen, president of Rolls-Royce Marine, declared that, “Autonomous shipping is the future of the maritime industry. As disruptive as the smart phone, the smart ship will revolutionize the landscape of ship design and operations”

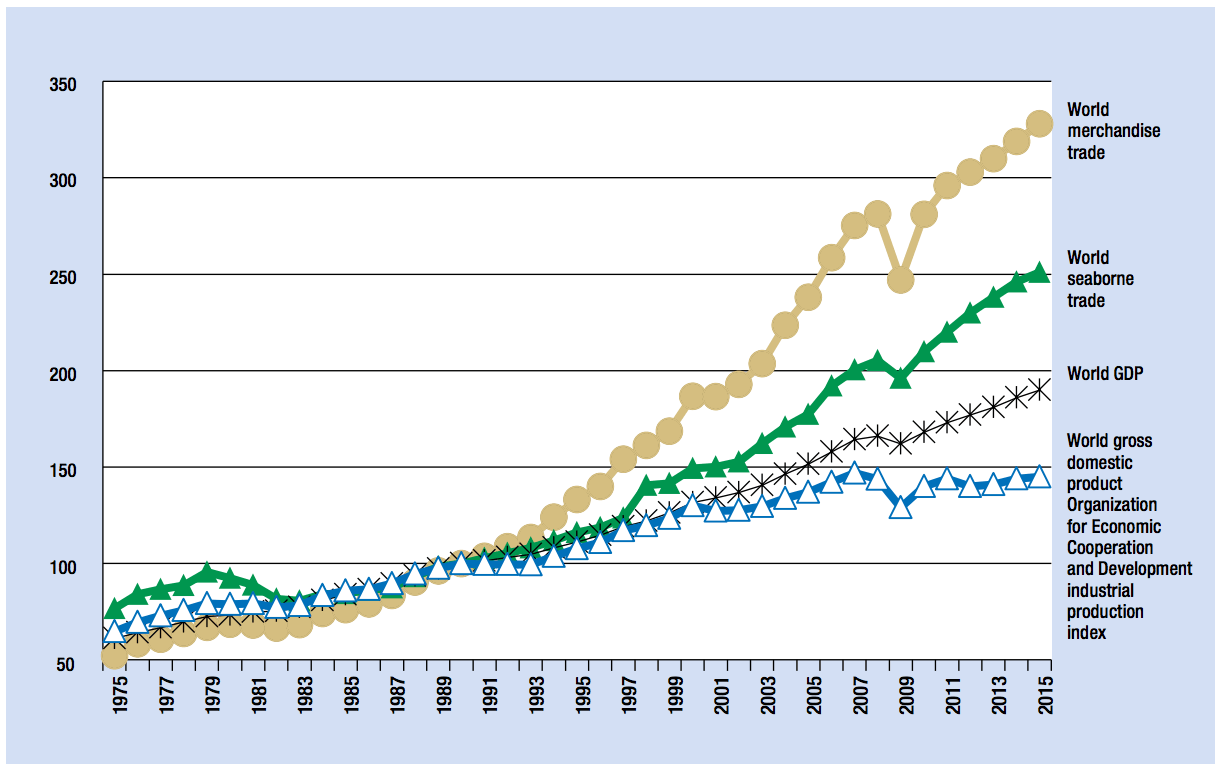

Globalization and international commerce is built on seaborne trade because it is often the most cost effective way to move large volumes of goods from one country to another. The United Nations Conference on Trade and Development estimated that in 2015, total seaborne trade volume surpassed 10 billion tons for the first time — roughly a four-fold increase since 1970.

Cargo ships are normally a much slower option than cargo planes or even trucks, so their core advantage is usually being a much lower cost option. This is why the shipping industry is always trying to find ways to bring down operating expenses. To keep international volume increasing, the industry needs to make shipping as cheap as possible. Bringing down the cost of transportation can make shipping new products across the world economically viable, opening new market opportunities.

Autonomous boats can obviously offer the advantage of reducing/eliminating the expense of salaries and benefits for crew members. This is more important for smaller vessels, where crew costs make up a bigger share of total costs, but less important on larger ships. For large ships, the other potential cost savings go beyond mere reductions in personnel costs.

1) Efficiencies of Ships Without a Crew

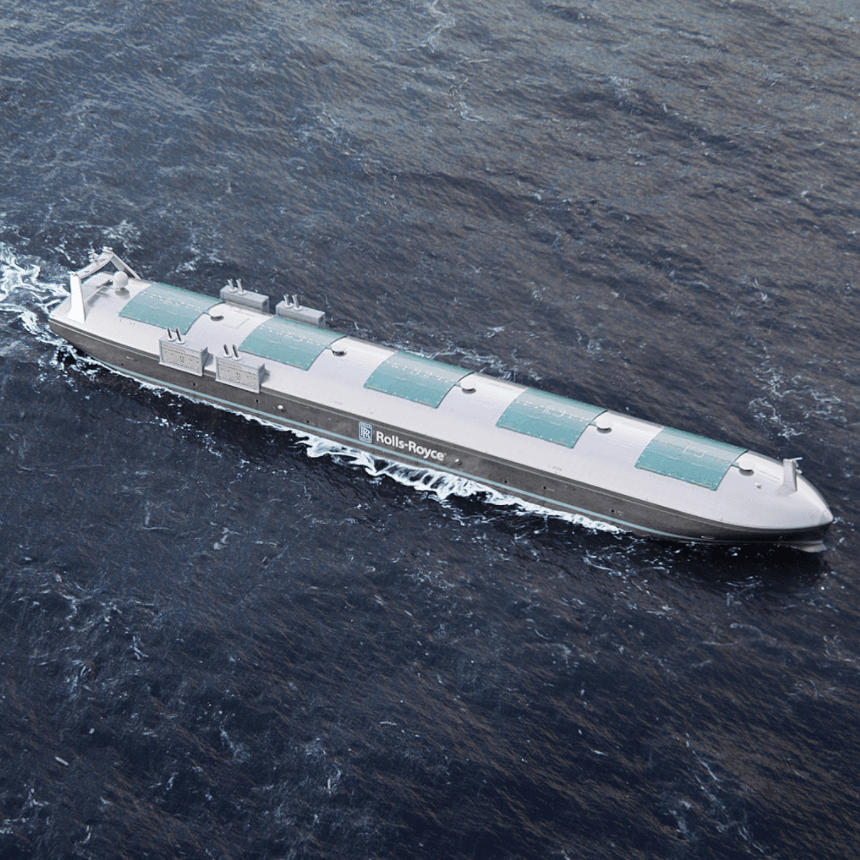

Once the need for having humans on board is eliminated, the entire vessel can be radically redesigned to improve efficiency in new ways. For example, systems once needed to make the vessel livable for the crew can be removed entirely, simplifying the design.

The deckhouse that currently sits above the deck of ships, holding the crew and allowing them to steer the vessel, would no longer be required. This could open up more space for cargo, possibly making loading easier, or allow for a more aerodynamic profile.

When automation becomes viable, the industry isn’t planning to just make the same cargo ships they currently do minus crew. They are planning on making a whole new class of vessels re-envisioned from the ground up.

It seems likely that crew reduction will occur before total crew replacement. Until robots become dextrous enough to fix engines or complete other routine onboard tasks, humans may need to be in the loop – even if just in the case of emergencies. Given the robotics applications for learning complex physical tasks (including surgery, factory assembly, and more), we might expect expect robotics crews to go along with autonomous vessels in the next decade ahead.

2) Reduced Human Error and Risk

Autonomy also holds the promise of reducing human error and therefore bringing down costs related to accidents and insurance. According to Allianz Global Corporate & Specialty, between 75% and 96% of all accidents in the shipping sector can be attributed to human error. These incidents rank as the top cause of liability loss.

The Costa Concordia disaster is perhaps the most famous example of how much damage human error can cause when dealing with massive ocean-going vessels. This isn’t to say that machines would never make mistakes, but we might imagine that in time machines will make docking and navigation overall (just as automation plays a critical role for aircraft).

Safety standards for seaborne craft have likely not seen as much dialogue and innovation as self-driving cars or trucks. In our AI in Industry interview with Eran Shir of Nexar Inc (titled “When Will Autonomous Cars be Mainstream?“), Eran mentioned many of the current safety protocols and warnings in autonomous cars today, such as the “forward collision warning” (warning drivers of when a vehicle ahead of them has stopped suddenly, a common cause of accidents). If these same kinds of accident-detection use cases are explored for autonomous ships, we might imagine a world where self-driving boats are almost ubiquitously safer for people and cargo.

3) Reducing the Risks of Piracy

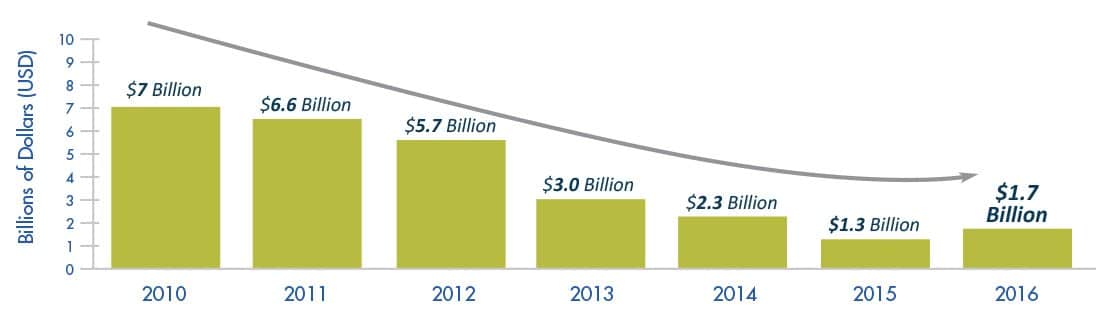

Meanwhile, without human crews to threaten or hold hostage, the issue of piracy along certain trade routes would also likely be reduced or mostly eliminated. Kidnapping crew members for ransom money is a main driving force behind modern piracy. According to the State of Maritime Piracy report, last year there were 18 incidents of kidnapping for ransom off the coast of West Africa and 21 incidents in Asia.

The economic cost of Somali piracy was $1.7 billion last year and it was as high as $7 billion in 2010. Pirate attacks in Sulu and Celebes Seas has result in some merchants choosing to change their routes which can mean longer delivery times.

How Autonomous Ships Work

Compared to self-driving cars, autonomous ships face different challenges which make the technical requirements harder to meet in some ways but easier in others. For self-driving cars to to produce a truly transformative paradigm shift, they need to be able to operate independently at almost all times. Autonomous vessels, by comparison, only need to operate without human input most of the time to significantly change that industry. In contrast to self-driving cars, the shipping industry doesn’t envision requiring the onboard AI to fully control the vehicle in every circumstance – at least not for a long time.

The shipping industry’s main goal from this technology isn’t to completely remove humans from the decision making process. To see the advantages they hope to gain from this technology, they just need to eliminate the requirement that humans be physically present on the vessels at all times.

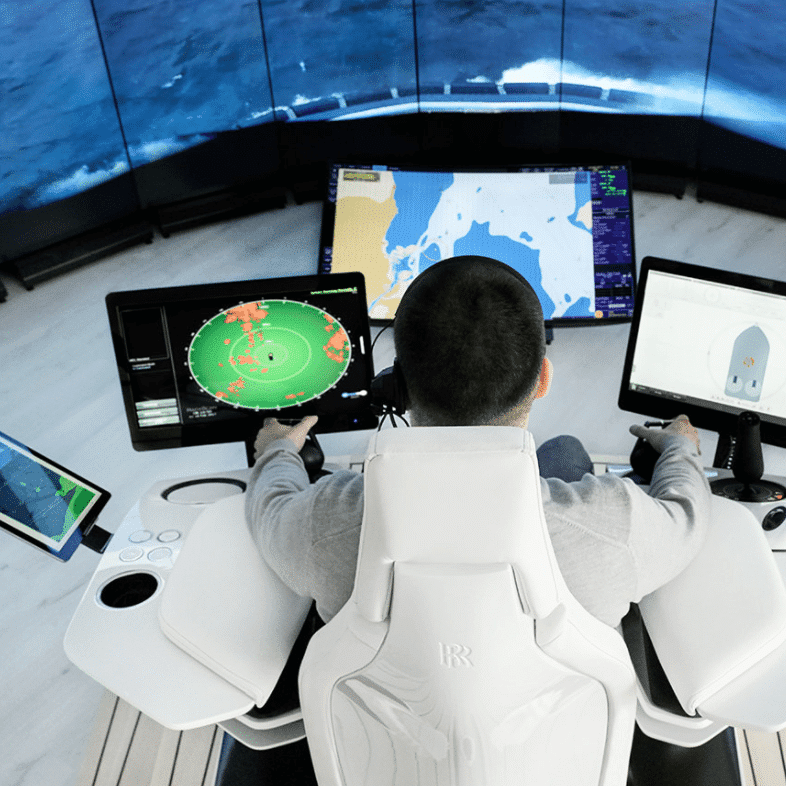

The vision put forward by companies like Rolls-Royce is to augment a mostly autonomous system with remote control. The onboard system would, for example, control the vessel during the long days at sea, which are relatively uneventful. Human operators would be called on to carry out higher level executive functions or deal with more difficult situations. When more difficult tasks are performed, like entering a port, the ship can be remotely operated by people on land.

According to Rolls-Royce’s vision put forward last year, “There will be no single remote or autonomous ship solution but rather a hybrid of the two which will depend on the type and function of the vessel.”

In the short term that means tugs that can be remotely operated from a nearby control center. In the long term, Rolls-Royce predicts a future in which a land-based control center staffed by just 7 to 14 people would be able monitor and control an entire fleet of large ocean-going ship around the world.

Timelines for Autonomous Boats to Hit the Water

Below we’ll look at current projects and executive statements of major autonomous shipping firms, and compare their timelines for autonomous shipping adoption:

1) Rolls-Royce Marine – Short Runs by 2020, Ocean Going by 2025

Rolls-Royce leads the Advanced Autonomous Waterborne Applications Initiative (AAWA) which is a €6.6 million project funded by the Finnish Funding Agency for Technology and Innovation to bring together ship designers, equipment makers, and universities to examine the future of autonomous ships.

According to the white paper produce by Rolls-Royce for the AAWA, “the technologies needed to make remote and autonomous ships a reality exist.” The necessary sensors, the communication equipment, the programming, etc. is all currently achievable.

The challenge is making the technology reliable and cost effective. Given the important safety concerns and financial investments involved in a single cargo ship, the technology will need extensive testing before being deployed.

The white paper also highlights that there are big legal, regulatory, and insurance issues. Even if the technology is perfected, companies aren’t going to use remote and autonomous ships unless countries change their laws to allow them to operate.

Despite some potential issues, Rolls-Royce is optimistic about the future of the technology. Oskar Levander, Vice President of Innovation-Marine has no doubt that autonomous ships will eventually transform the industry and claims that, “We will see a remote controlled ship in commercial use by the end of the decade.”

Levander believes autonomous ships will start as small vessels that operate in confined areas with a specific route, like a basic ferry. For legal and technical reasons, a well-defined, continuous back-and-forward run within a single country is where the first commercial applications of the technology will be used. For example, Rolls-Royce and Svitzer early this year demonstrated the first remote operation of a commercial vessel. It was a tug in Copenhagen harbour, Denmark controlled by a captain located on shore in a new state of the art control center.

This is an aspect of the shipping industry that should make it easier to steadily roll out remote and autonomous technology. Ship builders don’t need to first figure out how to make remote and autonomous ships operate under all possible conditions before they can start deploying them. There are plenty of shipping needs that only require a vessel to operate under very specific and limited conditions and still be economically viable.

Levander thinks the first remote controlled ocean-going vessel will emerge around 2025 and quickly become commonplace by 2030.

2) Kongsberg and Yara – 2020

Yara provides a perfect example of how we will see the technology most used in the very near future. Yara and Kongsberg plans to deploy the first autonomous and fully electric cargo ship in 2018. The vessel – christened YARA Birkeland – will start as a manned ship in 2018. The plan is to test the new vessel and slowly transfer more and more responsibility to the AI system. Their goal is to have remote operation in 2019 and basically fully autonomous operations by 2020.

Since the YARA Birkeland will only travel a short, well-defined route from a facility in Brevik to a facility Larvik and back, it will simplify the task of preparing this one ship for autonomous operation. This is exactly the type of operation where the early autonomous ships will be put to use.

3) Japanese Consortium – 2025

Japan’s most important ship building companies are betting on their country’s technological expertise to improve their current world standing.

At the beginning of this year, the Japanese Ministry of Land, Infrastructure, Transportation and Tourism announced a joint project between Mitsui O.S.K. Lines and Mitsui Engineering & Shipbuilding Co. to develop autonomous ships. The research consortium is bringing together companies, government agencies, and universities to create a technological concept for autonomous vessels.

The R&D effort is expected to cost hundreds of millions. The goal is shared expertise among several Japanese shipping companies to have autonomous ships by 2025.

We might imagine that autonomous ship adoption will be a function of a country’s budget, and of the importance of ocean transport to it’s economy. Japan and the UK seem to be likely adopters if this this holds.

In our previous interview with Accenture CTO Paul Daugherty (worth listening to for anyone interested in the economic impact of automation), Paul discussed the concept of “national absorptive capacity” – or the ability of a country to quickly adopt and leverage technology innovations. One of Accenture’s 2016 reports on the impact of AI on the economy ranked Japan as being on of the nations most poised to benefit financially from AI – based in part on their national absorptive capacity. We’ll see if this holds true for their developments in autonomous ships in the coming decade.

Concluding Thoughts on the Autonomous Sea Craft

Rolls-Royce and pretty much the entire Japanese shipping industry are investing millions into autonomous ship research and development. They feel confident in this bet because the actual technology to make such systems work effectively exists; the challenge now is refining it to produce the reliability and effectiveness to make it economically viable and safe enough to get the approval of regulators.

Many industry insiders expect the process to start in just the next few years, with remote and autonomous ships on short, defined routes by the end of the decade. They expect the technology to steadily improve until cargo ships are traveling the open ocean without crews (possibly between 2020 and 2025, based on today’s claims and projections). Once the technology reaches maturity, some companies believe the cost savings will cause it to be adopted rather quickly on a broad scale.

This drive is not just to reduce labor costs and human error but to allow a real transformation in the industry. Without humans being physically aboard, ship design is open to new possibilities to increase efficiency – creating vessels purpose-built for shipping, without the decks, bathrooms, kitchens, and sleeping quarters required on today’s vessels.

Long term, the implications extend well beyond the shipping industry. Bringing down the cost of transportation would not only reduce operating expenses for a whole range of industries but could create a variety of new market possibilities. Low value items that were not worth shipping before could become profitable.

Research suggests that containerization technology, which dramatically reduced shipping cost, was a main driver of globalization. Products with relatively low profit margins (possibly clothing, some types of food, and more) will enter far-away markets, bringing about heightened competition in sectors that previously had little.

It will likely be a decade before the impact is felt broadly, even if the technology develops at a rate some expect. Knowing if and when the technology will reach maturity should be fairly easy to follow and prepare for. Since the technology is predicted to soon roll out for simple routes and steadily expand to longer and more complicated routes, it should be easy in the next few years to gauge whether these predictions are on track.

The companies outside the shipbuilding industry which should be paying close attention in the short term are any which are constantly moving a modest amount of cargo a relatively short distance across or near waterways. Tugboats, ferries, and barges are were the first uses of remote and autonomous ships are planned – and these are likely to be the applications where autonomous ships will add real value in just the next few years.

Image credit: New Atlas