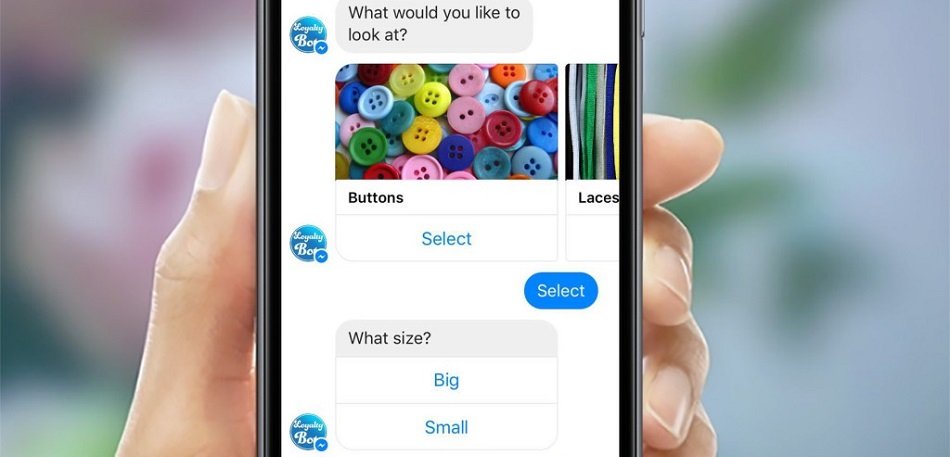

Chatbots for the Retail Industry – Current Applications

Adoption of chatbots—coded programs that can engage in some degree of conversation with human inputs, often through the help of artificial…

•

Matthew is Senior Editor at Emerj, focused on enterprise AI use-cases and trends. He previously served as podcast producer with CrossBorder Solutions, a venture-back AI-enabled tax solutions firm. Prior, Matthew served three years at the World Policy Institute as a news editor and podcast producer.