Data Collection and Enhancement Strategies for AI Initiatives in Business

There’s more to successful AI adoption than picking the right technology. Business leaders should be aware of the technical requirements of…

•

Dylan is Senior Analyst of Financial Services at Emerj, conducting research on AI use-cases across banking, insurance, and wealth management.

There’s more to successful AI adoption than picking the right technology. Business leaders should be aware of the technical requirements of…

•

Mitsubishi UFJ Financial (MUFG) is a Japanese holdings bank and financial services company ranked 5th on S&P Global’s list of the…

•

Large insurance companies have been experimenting with AI since the middle of the 2010s, piloting chatbots and collecting telematics data for…

•

The financial sector was among the first to adopt artificial intelligence in business by automating fraud prevention with anomaly detection technology.…

•

Event Title: Launch of the OECD AI Policy Observatory Event Host: OECD Location: Paris, France Date: February 26 – 27, 2020 Team…

•

Applying AI to the real world is much more difficult than applying it in digital ecosystems; this is what makes robotics…

•

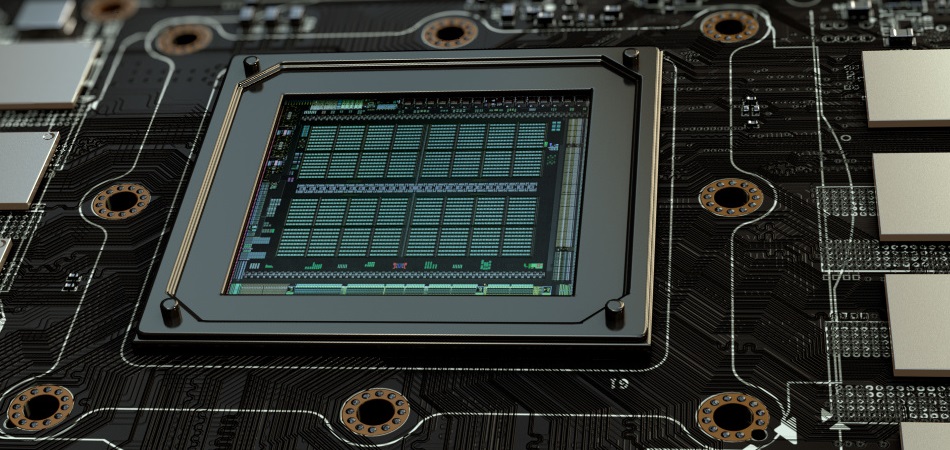

Large enterprises are eager to use artificial intelligence software, but many of them aren’t aware of the hardware required to execute…

•