Health insurance is a critical component of the healthcare industry with private health insurance expenditures alone estimated at $1.1 billion in 2016, according to the latest data available from the Centers for Medicare and Medicaid Services. This figure represents 34 percent of the 2016 National Health Expenditure at $3.3 trillion.

In this article, we will look at four AI applications that are tackling problems of underutilization and fraud in the insurance industry.

Some applications below claim that they are using artificial intelligence to help improve health insurance cost efficiency, while reducing waste of money on underutilized or preventable care.

Other applications claim to detect fraudulent claims. According to the US Department of Justice’s Health Care Fraud Unit, fraud can be committed when a provider charges a health insurance provider, such as Medicaid, Medicare, or a private insurance company, incorrectly at a higher amount for a patient’s procedure or appointment. The DOJ reports that fraud costs the health insurance industry over $100 billion a year.

In this article, we set out to determine the answers to the following important questions:

- What types of AI applications are emerging to improve health insurance efficiency and optimization?

- How is the healthcare market implementing these AI applications?

The majority of AI use-cases and emerging applications for the health insurance industry appear to fall into two main categories:

- Cost Efficiency: Insurance and similar health companies are developing software platforms to recommend preventative healthy habits and behaviors to patients, such as nutrition strategies and exercise. This lowers the cost of waste or loss on preventable healthcare expenditures that could be caused by unhealthy habits.

- Fraud Detection: Researchers are developing machine learning algorithms to analyze health insurance claims to predict cases of fraud.

Below, we present examples from each category, as well as the current progress (funds raised, pilot applications, etc) of each AI application. Before delving into the companies, we provide some context on how health insurance is designed.

(Readers with a more general interest in the use of AI in the insurance industry can read our full article titled: How America’s Top 4 Insurance Companies are Using Machine Learning.)

Understanding Health Insurance Costs – Brief Overview

Health insurance is anything but a linear process, a series of factors inform and influence how insurers design coverage packages. For example, under US law, health insurance companies consider and are limited to five factors to calculate premiums. According to the U.S. Centers for Medicare & Medicaid Services, these factors include age, location, tobacco use, enrollee category (individual vs. family) and plan category. Below is a description of each of these factors:

- Age: As individuals age, healthcare needs are expected to increase and to become more complex. As a result, insurers may set premiums up to three times higher for older adults compared to younger individuals.

- Location: This factor play a role in determining premiums as market competition and cost of living vary by state and local levels.

- Tobacco use: Tobacco users can be charged up to 50 percent more for insurance than those who don’t use the substance, according to US health regulations.

- Individual vs. family enrollment: By law, insurers can charge more for a plan that also covers a spouse and/or dependents.

- Plan category: This factor breaks down into five categories: Bronze, Silver, Gold, Platinum, and Catastrophic. Each category attempts to achieve a balancing act in cost sharing between premiums and out-of-pocket costs. For example, a less expensive plan, such as the Bronze category, often has higher out-of-pocket costs but lower monthly premiums. The inverse is true for plans with higher monthly premiums such as Platinum plans.

The factors outlined above and the significant burden of fraudulent medical and prescription claims costs weigh heavily on the insurance system. Examples of fraud include a provider billing for services that were not actually provided to a patient, or providing unnecessary medical services to generate insurance payments.

We will now look at how the following applications claim AI could help improve efficiency and cost savings.

Cost Efficiency

Accolade

Founded in 2007 with offices in Plymouth Meeting, Pennsylvania and Seattle, Wash., Accolade Inc. claims its Maya Intelligence platform uses machine learning to recommend informed health choices, such as helping patients choose the best health insurance coverage options to fit their needs, to promote quality of life and to reduce healthcare their costs.

Accolade works with employers searching for group insurance, but is also available to assist members of specific health plans as it provides personalized guidance on general healthcare provider and health insurance options. In addition to the Maya Intelligence platform, the company also allows users to communicate with human advisors with clinical expertise such as nurses.

In June 2017, the company announced the debut of the platform, with a goal of integrating multiple healthcare data information sets in digital format including benefit plans, medical and Rx (prescription) claims, lab results and interactions between the company’s clients and healthcare consultants and medical professionals employed by Accolade. The digital platform helps connect Accolade clients to providers.

Accolade reports that it currently serves just over 1.1 million clients, which include U.S. employees and their families. The health data used to train the Maya Intelligence algorithms are derived from the company’s clientele base.

The company says the platform operates using natural language processing to help analyze and synthesize data in text format, to extract meaningful insights and trends. Machine learning helps collect patient background, including “benefit plans, medical and Rx claims, biometrics results, risk scoring and demographics demographics” to build a patient profile.

According to a press release and promotional video from the company, when a patient logs in, they can access their profile as well as some demographic and company health insurance information. If the user wishes to talk to a nurse or medical assistant about a topic such as a medical or billing question, the platform has a referral feature that matches them up with the medical professional that best matches their background and needs. From there, the user can call their offices or send messages to a provider

This platform also can recommend company health insurance plan choices or other financial options to a user. According to a promotional video, the company also says the user can additionally take a photo of a bill, note where they have questions and send it to the health provider’s office.

In the short video below, Accolade employees and health providers discuss why they chose to create Maya, while noting some of its features:

In a case study, Accolade reports that the Temple University Health System (TUHS) was able to successfully reduce its healthcare costs amounting to $9.8 million in savings in their second year working with the company.

Prior to working with Accolade, TUHS health services said employees on the TUHS health plan were underutilizing preventative visits and scheduling infrequently scheduling covered medical appointments. This led to equivalent to four percent of revenue lost each year. Accolade says it helped TUHS employees and their families to more effectively navigate the services available through TUHS.

“We signed on to Accolade because we thought it would benefit our employees, and it did. In year one, we achieved close to 50 percent employee engagement and saved more than two million dollars in healthcare claims costs. In year two, those cost savings have more than quadrupled.” – John Lasky, Vice President and CHRO, Temple University Health System

As of March 2018, the company has reportedly raised $217.3 million in total funding. According to the LinkedIn page, Accolade’s data scientists include Ankita Jain, who holds a PhD in Computational and Applied Mathematics from the University of Houston.

Examples of Accolade’s clients include Teladoc Inc, a telehealth services company servicing over 7,500 clients, Mercer and AmeriHealth.

Collective Health

Founded in 2013 with headquarters in San Francisco, Calif., Collective Health claims that it uses machine learning through its online management platform to integrate population data, medical claims and queries to simplify healthcare management for employers.

In March 2017, the firm announced a pilot, introducing a recommendation engine for Collective Health clients (employers, insured employees, their families and their healthcare providers) that uses machine learning to personalize the healthcare navigation process to better navigate their health insurance options.

According to Collective Health, the CareX platform uses multiple algorithms trained on data sourced from claims and search queries on Collective Health’s Member Portal, as well as from interactions and inquiries between users and Collective Health Member Advocates.

CareX claims to identify patterns and recommend which solutions or programs will meet the health needs of each unique user (including employees and employers).

At the time of the press release, the company reported that it serviced 15 employer clients reaching 70,000 employee clients and their dependents.

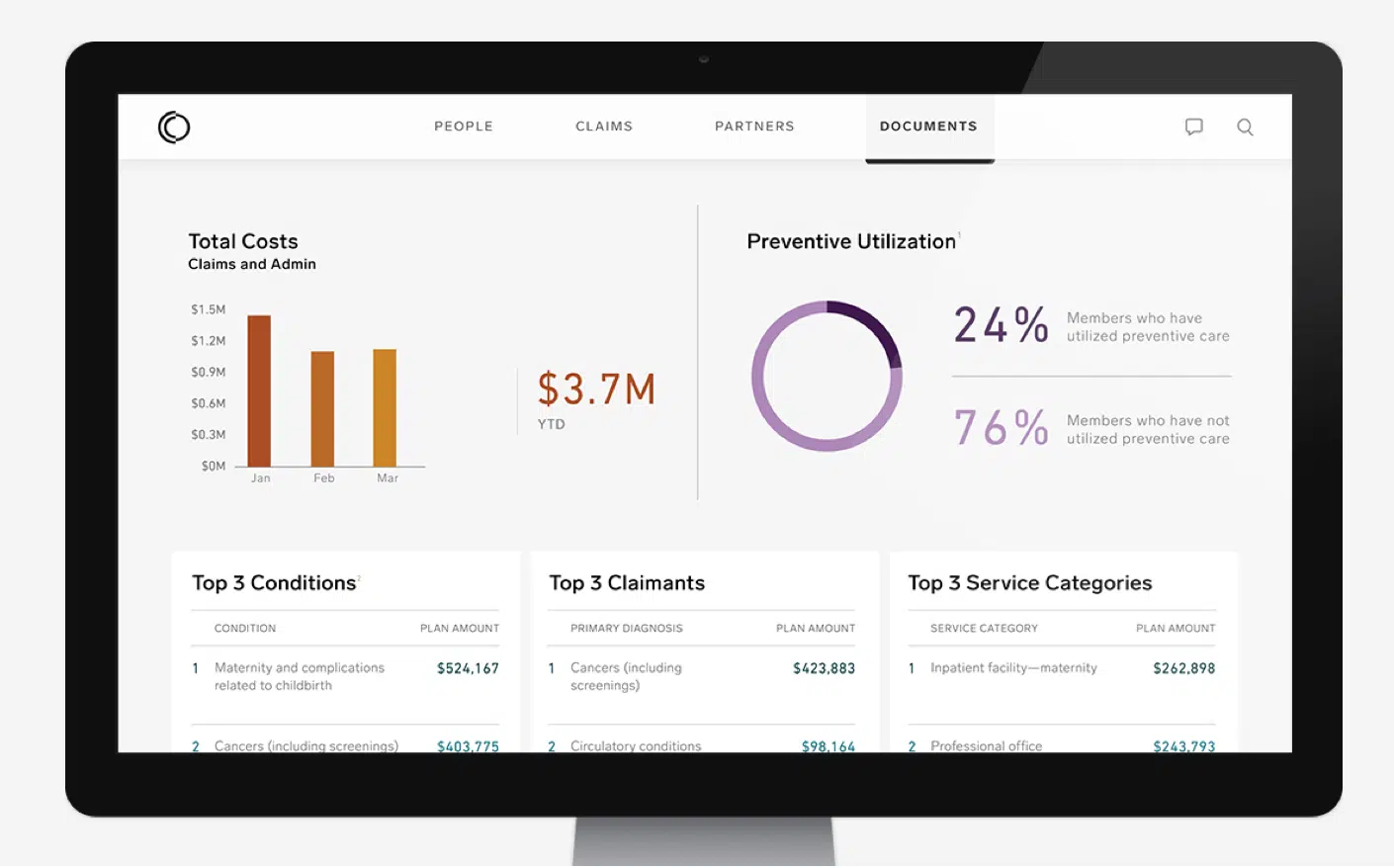

According to the company, when an employer logs into the platform, the dashboard allows them to click an option to learn more about their specific company plans and what they offer. The platform’s search engine allows the employer to use search criteria and location information to find recommendations for the potential health, vision and dental employee plans that they might want to select or move to.

Collective Health claims to be a one-stop site for company insurance plans, noting that once company plans are selected, an employee who opts into them can use the platform to get integrated health, vision, and dental insurance information, even if the plans are from different insurance providers.

The platform can also be used by an employee to locate a physician or health-related program based on search criteria. The company says a user can also receive recommendations of providers to see in their area and other insurance plans that the company might offer which may better fit their lifestyle.

When an employer returns to the platform, they can also see stats on insurance plan engagement, including how much preventative care (often covered by US insurance plans) is utilized by their employees.

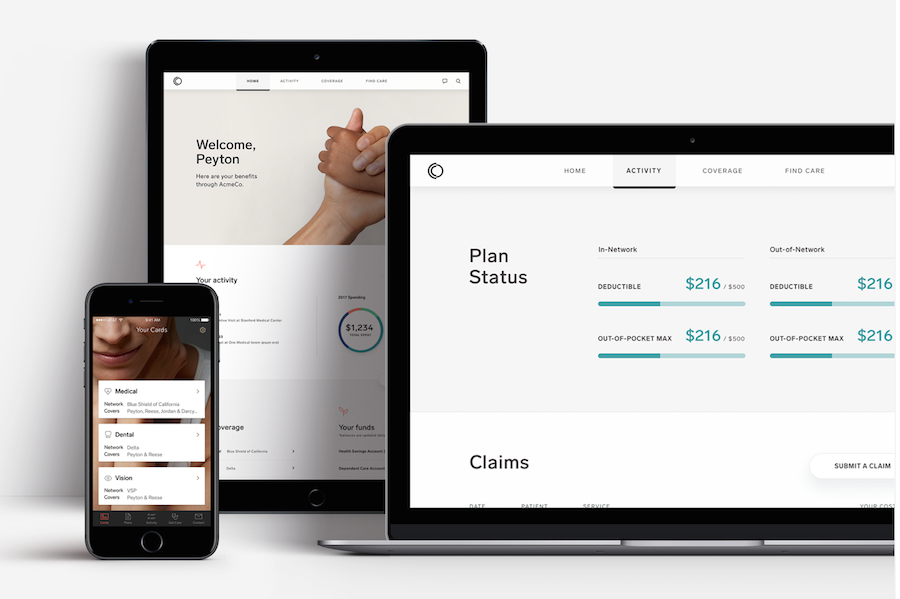

The company notes that healthcare providers can also use a different format of the platform to review claims or submit new claims. The platform is also accessible via mobile devices.

The below photos from CareX show how an employer can use the platform to track the percentage of members using covered preventative care and how an employee can use the platform to choose and track an insurance plan with their company.

Employer view:

Employee view:

Employee view:

While a demo could not be found, this 2-minute video, explains how Collective Health can help an employer pick insurance for its company and assist in helping employees take advantage of its features.

While a demo could not be found, this 2-minute video, explains how Collective Health can help an employer pick insurance for its company and assist in helping employees take advantage of its features.

The CareX pilot ran through 2017 for “select clients and their 15,000+ members” with expansion to other groups beginning in January 2018.

According to the firm’s website, examples of Collective Health clients include Red Bull, Jazz Pharmaceuticals and eBay.

According to Collective Health’s LinkedIn page, data scientists on staff include senior scientist Jim Kubicek, who holds a PhD in Mechanical Engineering from Carnegie Mellon University and Nicholas Gustafson, who holds a PhD in Neuroscience from New York University. As of February 2018, the firm has reportedly raised a total of $267 million.

Fraud Detection

Kirontech

Founded in 2014 with headquarters in Cambridge, England, Kirontech claims that its software platform, KironMed, uses machine learning to identify and reduce inefficiencies in the claims management process.

According to the company’s website, the KironMed algorithms are trained on large publicly available databases. Kirontech claims that its platform synthesizes this data to identify components of medical claims and detect patterns which correlate with health insurance fraud (inaccurate billing) or waste (i.e. underutilization of services).

Kirontech does not currently provide the names of its public database sources. However, examples of public databases include HealthData.gov; which includes data from the Centers for Disease Control, the US Food and Drug Administration and the National Institutes of Health.

The online platform is offered as a cloud-based service. When a user logs in they can use features to analyze risk analysis and prediction of possible losses. They can also get healthcare provider comparisons. No case studies are currently published on Kirontech’s website. Kirontech also does not offer a demo video.

As of March 2017, the company has reportedly raised a total of $3.5 million in Series A funding with Leap Ventures, a VC tech firm, listed as the principal funder. Kirontech’s founder and co-CEO, Tarek Nassar, is a PhD in Theoretical and Mathematical Physics with a decade of experience in the investment banking industry. He also reportedly holds patents in machine learning applications.

Among the 14 professionals associated with Kirontech on Linkedin are its Junior Data Scientist, Sandro Ephrem, a Computer Engineering graduate student based in Lebanon.

No demonstration or product shots of KironMed’s platform could be found on their website, Youtube, Vimeo or online searches.

Azati

Founded in 2001, Azati a software company based in Livingston, New Jersey claims that it leverages machine learning to detect and alert insurers of fraud on its custom self-service web and mobile insurance platform.

The company’s software solution algorithms are trained on a large volume of previously process claims. However, Azati does not specify the number of actual claims used on its website. Patterns correlating with fraud can be identified as connections between data are generated by the platform and revealed to the user through digital notifications.

When an insurer or policyholder for company insurance logs into the platform, they can keep track of policies and claims through a simple dashboard that Azati can customize to fit the insurance company’s needs. If the system detects a possible case of fraudulence when analyzing new claims, Azati says it notifies human specialists at the insurance company so that an investigation can be done. The software platform also provides descriptions for tagged claims, explaining the factors used in making that determination.

When an insurance provider logs into to the online portal, available options from the Azati-built dashboard include insurance billing and coding, administrative document management and claims management. Azati says its platform is also a customized CRM (customer relationship management) software solution which can integrate data and documents directly from its client.

According to Azati’s LinkedIn page, a search for data scientists revealed a single result, Alla Khramkova, who holds a Master’s degree in Economic Cybernetics from a Belarus-based University, Yanka Kupala State University of Grodno.

In a case study, the firm claims that it helped to optimize an unnamed insurance company’s business workflow and to “detect fraudulent cases three times more accurately than before.” Prior to working with Azati, the insurance company needed to invest a significant amount of time and resources to determine the credibility of each claim it received. The case study does not include data on cost savings or revenue.

Azati, a software company that claims to create solutions for multiple industries, does not have a demo specifically for its insurance platform.

However, its insurance services page includes a product image which shows what one of their pre-built customizable platforms might look like for an insurance company.

To date, the company says they have roughly 330 clients and a team of roughly 105 professionals in various disciplines in addition to insurance such as finance, education and entertainment. Azati has not named its insurance industry clients to date.

Concluding Thoughts

Machine learning is well suited to handle the massive datasets that must be analyzed and evaluated to streamline health insurance procedures. As the majority of applications are still relatively early in their implementation process, more case studies will be necessary to prove cost savings potential and ease-of-use for all end-users.

Looking ahead there are some important factors to consider for health insurers seeking to implement an AI software solution for claims management. Accolade’s platform, which uses natural language processing, seems to be a natural fit for document analysis. Therefore, insurers may want to make sure that invoices from hospitals are in a digital format to optimize system processing.

It is also important to remember that the value of an AI solution is complemented by strong procedures. Insurance companies should have a well-established claims management procedure in place beforehand. For example, Collective Health’s CareX relies on robust claims data to train its algorithms and to optimize the performance of its platform.

For example, Azati’s insurance platform may require human specialists to be ready to receive and address claims when they are flagged for potential fraudulence. Having a clear step-by-step procedure in place for next steps will help insurers meet their goals.

Economic and political factors are also poised to impact the insurance market. The Centers for Medicare and Medicaid Services projects that tax legislation which eliminated the individual mandate, combined with GDP growth and employment trends may contribute to a slight decrease in the insured population from 91.1 percent in 2016 to 89.3 percent in 2026.

In anticipation of these market fluctuations, we can expect increased adoption of AI solutions in the health insurance industry among companies seeking to cut costs, scale up operations and improve client outcomes.

Header image credit: thebalance.com