Square is a financial services company that aims to “build common business tools in unconventional ways so more people can start, run and grow their businesses.” Founded in 2009 in San Francisco by Twitter Co-Founder Jack Dorsey and Jim McKelvey, Square reports total net revenue of $9.5 billion for 2020.

Originally known for its card-reader dongles, Square has expanded to create a business toolkit for small business owners, including various hardware and software products and services such as Square Capital, Square Terminal, and most recently, Square Banking.

In this article, we explore how artificial intelligence and machine learning is used at Square, examining two current use-cases:

- AI for payment fraud protection: how Square aims to ensure that sellers are protected from fraudulent transactions by analyzing and monitoring live transactions and offering various software solutions, such as Risk Manager.

- Small business lending with Square Capital: how Square offers loans to small businesses who may otherwise not qualify by traditional lending standards by assessing default risk, revenues, and other metrics to determine a seller’s eligibility through its service called Square Capital.

We will begin by taking a closer look at how Square uses machine learning to enable its various software solutions that aim to increase fraud protection for sellers.

AI for Payment Fraud Protection

As a primary service, Square provides payment processing systems and tools for small business owners. Along with that, Square prioritizes risk management services for its sellers to help protect them from fraudulent payment activity. “We offer payments and other products and services to a large number of customers,” Square writes in its 2020 10-K. “We have programs to vet and monitor these customers and the transactions we process for them as part of our risk management efforts.”

The exposure is huge. According to the PwC’s 2020 Global Economic Crime and Fraud Survey’s US findings, US companies suffered a total of $6.5 billion in losses due to fraud over the 24-month period surveyed. They also reported that “the rate of fraud and economic crime remains at a record-high in the US, experienced by 56% of US companies in [the] survey – significantly higher than the global aggregate of 47%.”

Square turned to AI early. Soon after its founding in 2009, even with very little data, the company claims it began its risk management and fraud protection procedures with “simple heuristics … plus manual review.” As Square collected data, they built machine learning models designed to detect risk and fraud.

Detecting and preventing fraud with AI makes sense as an early stop for businesses beginning the road to digital transformation and AI tools. Among its potential benefits, AI can:

- put new and innovative technologies to work in creating better customer experiences

- detect suspicious behavior that resembles instances of fraud detected in the past

- identify potential fraud red-flag anomalies in large datasets that merit human research

- help stem the financial losses suffered by US companies to fraud each year

Square claims to use machine learning algorithms to monitor transactions and create risk evaluations that can be reviewed by sellers in their transactions dashboard, stating that these tools “build [their] machine learning models based on thousands of signals from [their] payments ecosystem.”

The company also explains that when a transaction is deemed to be high risk, they may not automatically decline it because they believe it’s more important to convey the risk level to the business owner and support them in making an informed decision based on the knowledge they have of their customers.

Below is a short 90-second video explaining how Square aims to protect businesses from fraudulent transactions and the negative consequences they could bring:

While standard fraud monitoring is available at no additional cost to business owners that already use Square to process payments, Square also offers a paid software solution for business owners interested in additional “insight and functionality to prevent unnecessary loss,” called Risk Manager. With Risk Manager, Square claims on page 9 of its most recent 10-K, sellers can gain insights into online payment fraud patterns and establish custom alerts and rules to detect potential fraud red flags.

Square demonstrates how to access and set up Risk Manager in a 3-minute video below:

Another service called Square Secure provides business owners with email notifications for transactions that appear suspicious. Square explains that this service provides live monitoring of a business’s transactions while also identifying, reviewing, and reporting any transactions that they suspect to be fraudulent.

A 2017 Barron’s article highlighting the insights of Mizuho analyst, Thomas McCrohan, states that Square processes approximately 3 million transactions daily worldwide and only has to manually review “fewer than 2,000 of them for fraud, thanks to artificial intelligence.”

Today, Square claims to have “saved sellers $330 million since 2011 by managing and winning their disputes for them.”

Small Business Lending with Square Capital

Many small businesses rely on loans to achieve growth and manage liquidity. According to a report by the Small Business Administration (SBA), 38% of US-based businesses sought financing to help expand in 2020, down from 56% in 2019. This presents an opportunity for Square to invest in AI-based lending solutions because of the company’s unique, in-depth perspective of the overall financial health and proprietary data of sellers that use their platform, which allows them to make more informed decisions.

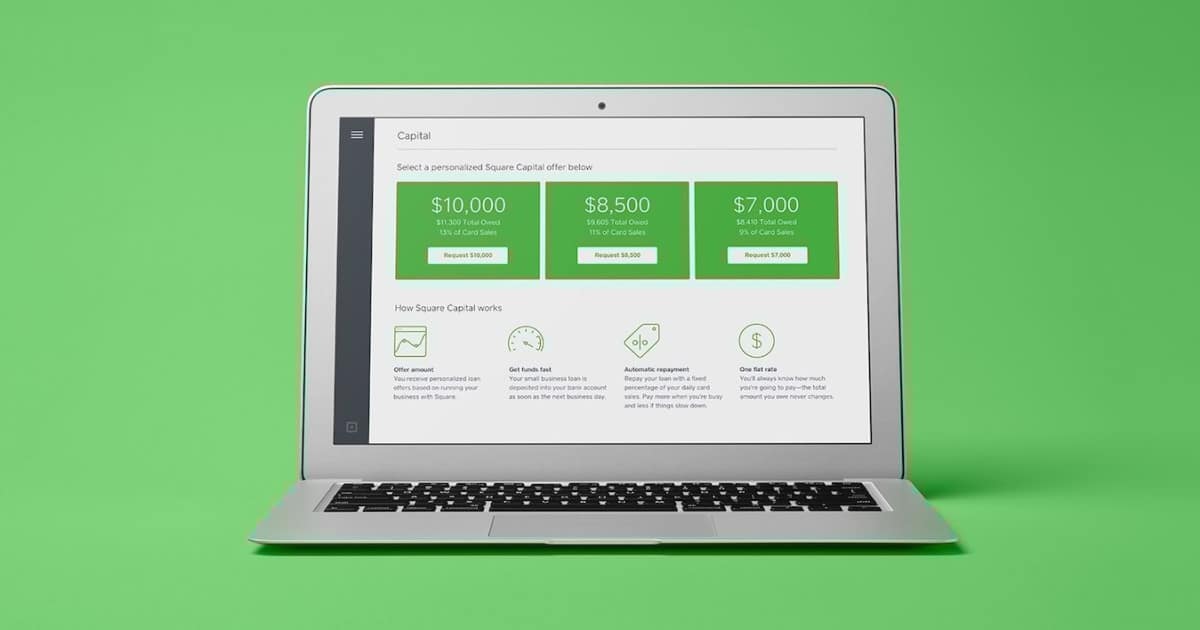

Additionally, Square Capital aims to make it easy for eligible sellers to source the funding they need to boost their businesses. Square Capital monitors transaction history as small businesses use their tools and services to process payments and uses this data to determine if a small business is eligible for a loan, the loan amount, etc.

Below is a short video of a 2019 interview with Jackie Reses, the former Head of Square Capital, in which she explains how Square assesses seller eligibility, default risk, and loan terms including repayment:

One of the components Reses highlights is the company’s overall aim to make the borrowing process more convenient for small business owners. She explains that when a seller is deemed eligible, they will be able to browse their loan offers directly from their seller dashboard, the tool they would use every day for processing payments.

Square currently claims to have extended over $9 billion in funds to approximately 460,000 small businesses around the world between May 2014 and March 2021, including PPP loans administered under the SBA’s Payment Protection Program. Sellers repay loans directly from funds collected through Square’s platform and do not need to process and issue separate loan repayments.

Loan repayment terms consider a business owner’s revenue – a fixed percentage of a seller’s daily sales is automatically deducted until their loan is repaid in full. Square states, “if sales are up one day, you pay more; if you have a slow day, you pay less. A minimum of 1/18 of the initial balance must be repaid every 60 days.” Additionally, any balance remaining after 18 months is due in full.

Of the company’s $9.5 billion in net revenue in 2020, Square reported in their 2020 10-K form that subscription and services-based revenue, including that produced by Square Capital lending, totaled approximately $1.5 billion. While our secondary research was unable to find a report from the company on revenue generated from lending alone, this segment makes up about 15% of their 2020 total revenue.