Sam Walton opened his first Walmart in Rogers, Arkansas in 1962, capitalizing on his twelve years of success running Walton’s 5&10 in downtown Bentonville seven miles down the road. Walton founded his company on the idea that retail could succeed by offering great value and great service. His competitors thought his idea was doomed to fail. Today, almost sixty years later, Walmart has transformed itself into a multinational corporate supergiant ranked as the largest company in the United States by gross sales in 2020, according to the Fortune 500.

Today, the well-known multinational retail corporation is the world’s largest in terms of revenue and its largest private employer. Still owned and controlled by the Walton family, Walmart has been publicly traded on the New York Stock Exchange since 1972.

In this article, we’ll compare Walmart with its main digital rival, Amazon, and explore two unique AI use-cases deployed by Walmart today.

We’ve broken this article out into four sections:

- Walmart vs. Amazon

- Walmart’s Transition to eCommerce

- Use-Case 1 – Item Substitutions for Grocery Orders

- Use-Case 2 – Remote Fitting Rooms

Walmart vs. Amazon – A Comparison in Performance and AI Adoption

While Walmart holds the distinction of being the country’s largest company with 2020 revenues exceeding $559 billion, Amazon, its chief and up-and-coming rival, is quickly closing in. Amazon’s 2020 revenues totaled $386 billion.

The firms differ significantly in terms of their growth. In 2010, Amazon’s revenue was $34.61 (under 10% of its 2020 revenue), and Walmart’s revenue was $404.74 (72% of its 2020 revenue). Hence Amazon’s market cap of $1.56 trillion (over 400% of revenue), compared to Walmart’s $382 billion (68% of revenue). But revenue growth is only one part of the market cap disparity – technology adoption and innovation is another.

In Bellevue, Washington, there’s a full-size grocery store where customers can “Just Walk Out.” From 7 AM to 10 PM, every day, you can grab fruits, vegetables, meats, and prepared foods from its shelves, go to the front of the store, and skip the checkout line. Customers happily report saving time … and reducing contact with others.

The store isn’t a Walmart Supercenter. It’s an Amazon Fresh. The first Amazon Fresh opened in Bellevue, Washington in August 2020. The chain has since grown to include fourteen additional locations in California, Illinois, Virginia, and Washington, DC.

Walmart’s grocery stores haven’t caught up. While Walmart offers self-checkouts, pickup, and delivery (and, of course, traditional staffed checkouts), the chain hasn’t yet brought all the innovations promised by computer vision, deep learning, and sensor fusion to its checkout process. Why?

In many ways, Walmart’s brick-and-mortar birth in Arkansas in 1962 has lengthened its path to the AI world of the 21st century. Walmart, for its part, piloted its “Scan & Go” program in 125 stores in 2017 and 2018. When it canceled the program three years ago, Walmart claimed that empowering customers to scan their own items via smartphones never really caught on.

Soon after, at the 2019 National Retail Federation’s Big Show, Walmart EVP and CTO Jeremy King went on to say that he was “really excited” for computer vision and what it promised in the “next couple of years.”

Fast forward to 2021 and Scan-and-Go is back, available to Walmart+ members who pay the membership fee. While it’s a way of capitalizing on the promise of computer vision, customers still have to scan each item with their smartphone’s camera. And that seems much less futuristic than, say, just walking out of a store with your account all settled.

Walmart’s Transition to eCommerce

Lagging Amazon in digital maturity, Walmart is trying to put its nearly 60 years of brick-and-mortar success to work as it faces new decades and technologies.

Walmart has been a leading mass merchandiser of consumer goods for a really long time, but its road to AI has not always been smooth. Now, it’s starting to catch on to the value that AI can bring to its business model.

In its 10-K discussion about its strategic risks, Walmart recognizes the potential pitfalls of failing to keep up with investments in technology and in failing to timely or effectively respond to consumer trends and preferences. Walmart clearly notes these exposures in its Risk 1A Risk Factors in its most recent 10-K.

“The retail business continues to rapidly evolve and consumers increasingly embrace digital shopping,” Walmart writes. “As a result, the portion of total consumer expenditures … occurring through digital platforms is increasing and the pace of this increase could continue to accelerate.”

Spurred on by pandemic spending, Walmart’s e-commerce sales grew by nearly 80% during 2020, a stat that bodes well for Amazon’s future digital investments. Walmart has made some visible investments into its digital future by exploring the innovations that AI brings to the mass merchandising consumer goods business. Below, we explore the rivalry between Walmart and Amazon and two important AI-related initiatives at Walmart and the problems they solve for the chain’s customers.

Use-Case 1 – Item Substitutions for Grocery Orders

Many of us have been there. You place an order online for groceries. You submit the order and pay. Then, when you arrive at the store for pick-up, a store employee delivers the list of substitutions. Sometimes, it’s just one brand of eggs for another. Once in a while, you find out that you’re out of luck: you’ll be short taco shells for Tuesday night tacos.

Unexpected substitutions lead to a negative customer experience – and potentially lost revenue or market share (to competitors like Amazon) for Walmart.

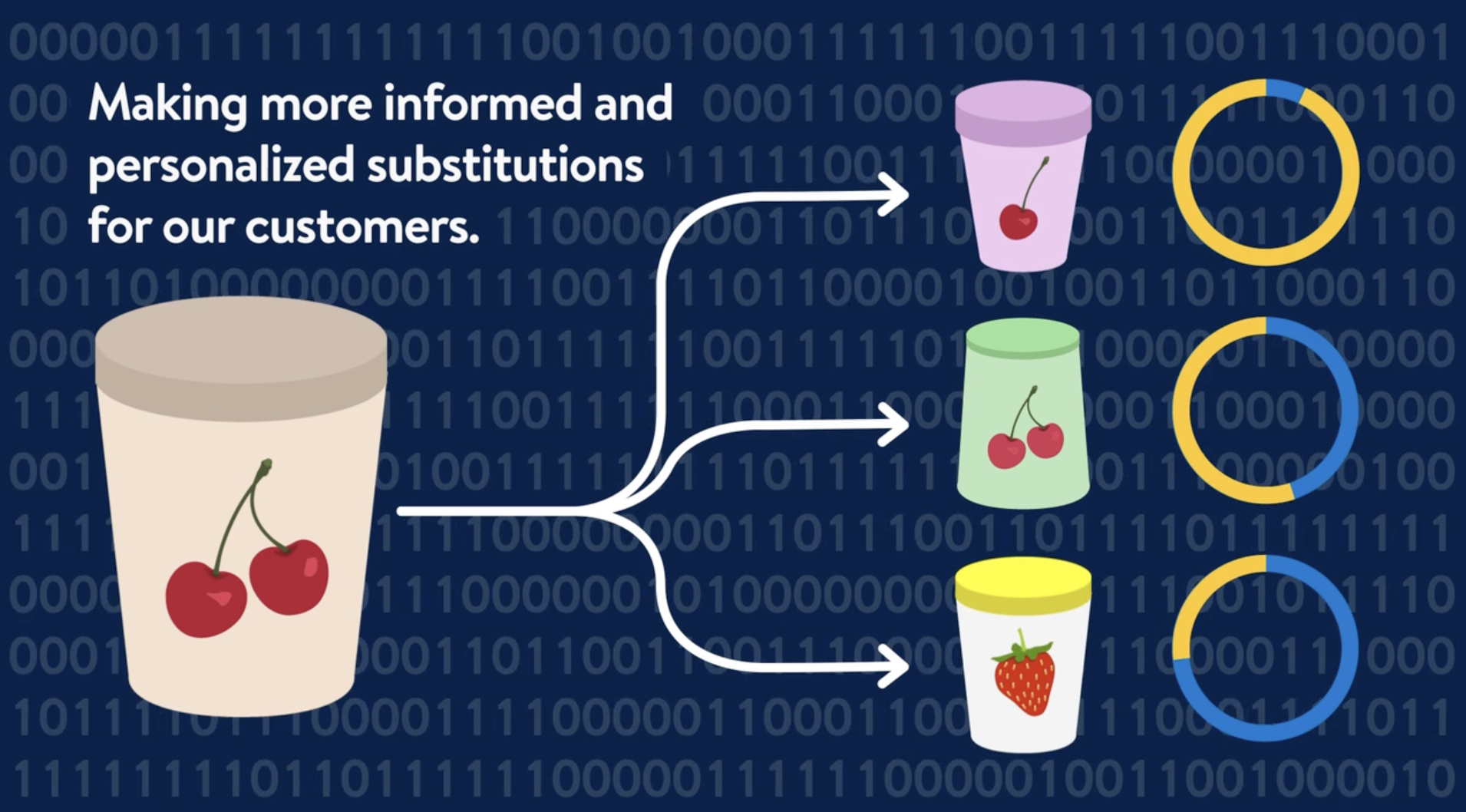

Walmart wants to make it easier for its employees to decide on the right substitute when your requested item isn’t on the shelf — a timely innovation with surging demand for online grocery shopping during the COVID-19 pandemic.

“The decision on how to substitute is complex and highly personal to each customer. If the wrong choice is made, it can negatively impact customer satisfaction and increase costs,” wrote Srini Venkatesan, Executive Vice President, Walmart Global Tech in a June 24, 2021 article for Walmart’s website.

Walmart claims that its item substitution solution incorporates deep-learning AI that evaluates hundreds of variables like:

- Brand and price

- Individual customer preferences

- Current inventory levels

- Aggregate shopper demand

The solution then communicates in real-time with the customer, asking them to approve or reject the item substitution. If the customer turns the substitution down, they are prompted to provide a reason. These data are then fed back into the solution’s dataset and used to inform its algorithms and improve future recommendations.

The solution also helps Walmart’s associates. Its AI delivers informed substitutions to Personal Shoppers as they navigate Walmart’s stores to complete shoppers’ orders, and it also tells them just where to find the item in the store, making their order fulfillment more efficient.

After implementing this AI-enabled substitution solution, Walmart claims that customer acceptance of substitutions has increased to over 95%. We can estimate that this purported improvement of acceptance will help to improve Walmart’s customer satisfaction, and help the firm to maintain market share. Walmart doesn’t list the before-and-after acceptance rate of substitutions.

Use-Case 2 – Remote Fitting Rooms

When you buy clothes online, it’s hard to know how they’ll look and fit. Beyond that, shoppers navigate the complexities of shipping charges and return policies. Even in a world where online interactions have moved recently to new and surprising facets of our lives, the comfort of buying clothes in person has persisted, if only because fitting rooms answer many of our concerns before we purchase new clothing.

For retailers, returns of ill-fitting clothes can exert real downward pressure on otherwise healthy sales. Up to 40% of merchandise purchased online gets returned, David Sobie, co-founder and CEO of Happy Returns, told CNBC in a 2019 interview. That means real money leaving Walmart’s P&L in reduced net sales as well as other processing and handling expenses that the retail giant must absorb.

Enter Walmart’s AI aspirations. In May, Walmart announced plans to acquire Zeekit, an Israeli company that makes the virtual trying-on of clothes a fun and social experience. When Zeekit’s solution goes live on Walmart.com, customers will upload their photos, choose a model that best represents their height, body type, and skin tone, and then try on clothes virtually. The solution will also allow them to share their picture with friends—the equivalent of having a trusted advisor outside the fitting room door to deliver a thumbs-up or thumbs-down.

Zeekit’s short one-minute clip from their coverage on Good Morning America highlights the basic features and user experience of the app:

How does it work? The Zeekit tech breaks—into thousands of segments—both the image of the person and the clothing. It then recombines them to approximate what the clothing will look like when worn. The tech can also help shoppers visualize how different pieces of clothing will appear when paired.

As part of the acquisition, Zeekit’s CEO, CTO, and VP of R&D will join the Walmart team, bringing a wealth of AI, computer vision, and real-time image technology to the consumer goods giant.

Just two months post-announcement, it’s too early to cite gains to Walmart’s customer satisfaction levels or its bottom line. However, if remote fitting rooms can help build consumer confidence before they add an item to a cart, that can go a long way to helping reduce returns and restocking expenses for retailers like Walmart.