Mitsubishi UFJ Financial (MUFG) is a Japanese holdings bank and financial services company ranked 5th on S&P Global’s list of the top 100 banks, and the largest Japanese bank on the list.

MUFG has recently begun a number of new projects pertaining to their data infrastructure and the use of AI in the enterprise – including deep learning and natural language processing (NLP) for credit assessment and predicting investment outcomes based on risk estimates.

MUFG’s plans for leveraging AI and renovating their data infrastructure include:

- Near-term plans for Digital Transformation: How MUFG intends to renovate their data and tech infrastructure in order to enable their AI initiatives.

- AI-enabled Corporate Performance Forecasting: MUFG’s partnership with the AI vendor Xenodata for forecasting financial risks and profit and loss.

We begin our coverage of MUFG’s digital transformation initiative with their near-term plans for changing their tech and data infrastructure.

Near-term plans for Digital Transformation

According to MUFG’s 2019 Digital Strategy document, the company has significant plans to update its data infrastructure. It plans to include machine learning, deep learning, and natural language processing (NLP) for wealth management and credit assessment use-cases.

MUFG intends to improve 10 of its internal processes by restructuring how its databases organize and how its staff access information:

- Sales channel

- Wealth management

- Wholesale banking model

- Real estate

- Asset management

- Institutional investors

- Global CIB

- Overseas operations

- Human resources

- Corporate center operations

While it’s unlikely that all of these processes will see AI deployments in the year ahead, many of these areas are more ripe of AI improvement than others. Our AI Opportunity Landscape research highlights current areas of AI ROI and traction in banking. Combining are understanding of existing AI trends in banking and known use-cases, we can extrapolate some of the AI investments that MUFG might attempt in the years ahead.

In order to automate credit assessment, MUFG would need to leverage machine learning systems trained on volumes of customer financial data. Additionally, MUFG would most likely apply predictive analytics technology in order to produce an AI software that can accurately predict creditworthiness. A wealth management application would have similar requirements, but may also include NLP for extracting important information from documents such as bills and payment contracts. This type of application would likely extract important information for financial advisers to use when reviewing their clients’ financial situation.

Transformation efforts within such a large bank’s digital infrastructure will take time. That said, the company could begin testing and experimenting with machine learning once the infrastructure has changed enough to be accessible by machine learning algorithms.

The same is true for NLP in terms of processes that require human outreach such as customer service or human resources. MUFG could leverage an NLP application that is trained to handle both customer service and human resource-related questions. They would simply need to train the machine learning algorithm on a dataset applicable to both consumer banking customers and banking employees.

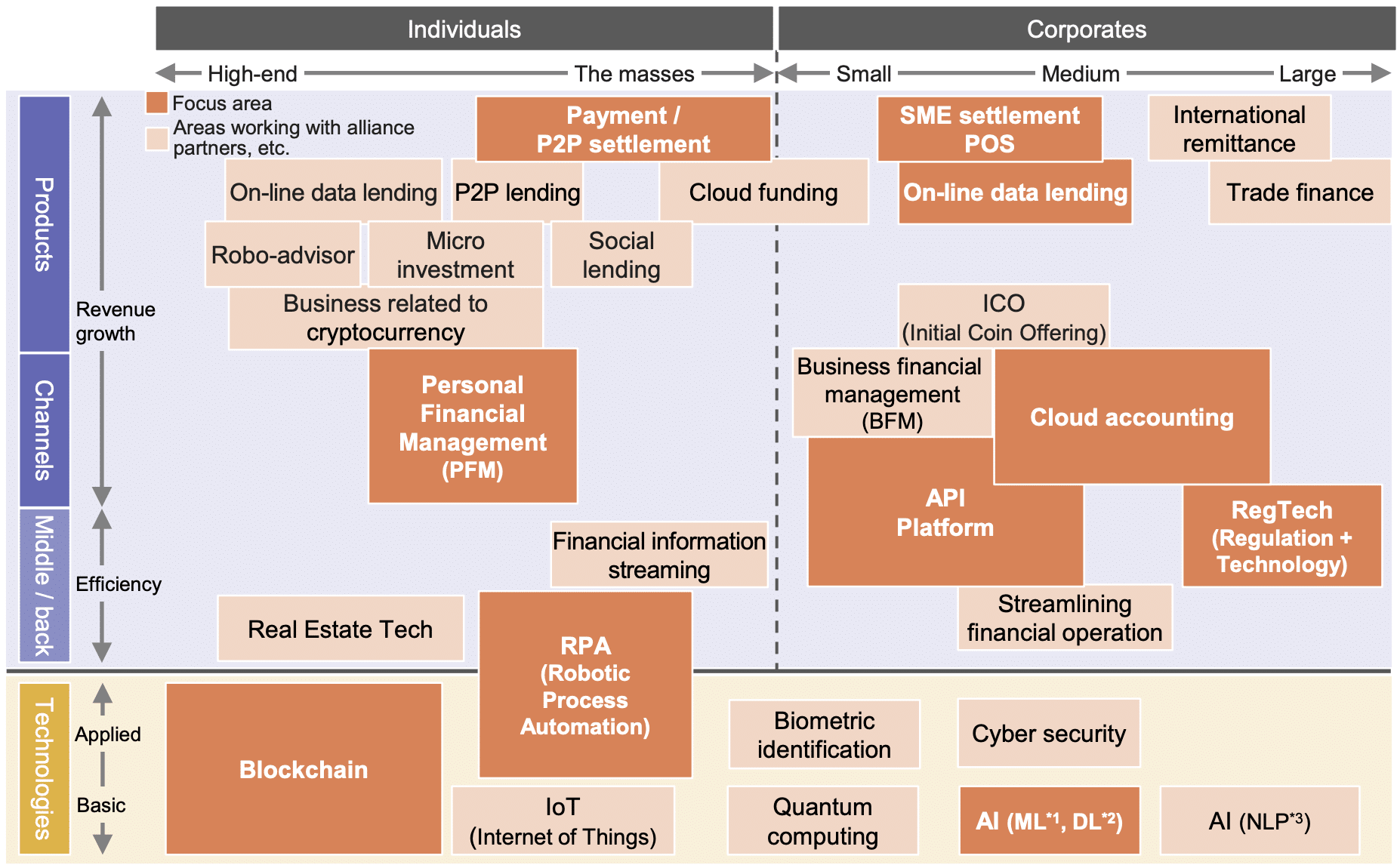

The following image from MUFG depicts which technologies they want to use to solve different types of problems. Included are ML, deep learning, and NLP in the bottom right corner:

According to the graphic, MUFG intends on using AI capabilities to streamline financial operations and international remittance. Additionally, they list cybersecurity within the same cluster of AI capabilities.

Our secondary research leads us to believe that Mitsubishi has more AI aspirations than they do applications, but the possibilities are numerous and the firm certainly has the financial strength to push AI initiatives forward – though it may need to draw upon AI talent from beyond the borders of Japan.

AI-enabled Corporate Performance Forecasting

MUFG invested in AI startup Xenodata, which is working with Kabu, a subsidiary of MUFG, to develop a corporate performance forecasting application. Xenodata offers a solution called “XenoBrain,” which can purportedly help Kabu better understand the financial risk of its clients. The vendor claims its software uses NLP to understand global news, financial news, security reports, and historical banking data to predict this risk.

Using XenoBrain, MUFG and its subsidiaries might see the following benefits:

- Risk estimates for new business initiatives: The application can purportedly gauge the risk associated with projects such as new ad campaigns or promotions using news and business sector data.

- Profit and loss predictions: Kabu and MUFG may be able to use the application to predict how their profit and loss records will look if they take a certain risk. For example, XenoBrain purportedly detects risk factors in clients such as incomplete or duplicate account information. This may reduce risks such as sudden cancellations or incomplete collection of accounts payable.

- Alerts for financial news updates: Currently, select Xenodata customers could benefit from direct email alerts when the software discovers new risk factors from incoming data.

Dive Deeper into AI in Banking

Emerj Plus members not only get access to our full list of AI Best Practice Guides and AI White Paper Library they also gain access to our AI Capabilities Matrix, a unique “landscape” view of our AI coverage across industries:

If you need to make a powerful business case for AI, or if you sell AI-related products or services, you’ll want to unlock the full resource library we’ve created for Plus members. Learn more about Emerj Plus.

Header image credit: Wikipedia