Robo-advisors are digital platforms that provide automated, algorithm-based financial planning services with little to no human supervision.

In the past decade, financial technology companies have elevated robo-advisors to now handle more complex tasks such as tax-loss harvesting, investment selection and retirement planning. To begin using a robo-advisor, most of these services first request customers to log into the application and respond to a short survey about their current financial situation and future goals. The software then uses the data to analyse the user’s current financial standing.

Some applications are able to recommend financial steps to grow the user’s wealth and automatically invest or balance the investment allocations. Others are capable of tracking the user’s spending based on the bank or credit account activity, and suggest budgets.

With the wealth management convenience that these applications offer, the industry has experienced such explosive growth that Deloitte estimated that the assets these digital tools will manage could potentially grow to $5 trillion to $7 trillion by the year 2025 in the US alone.

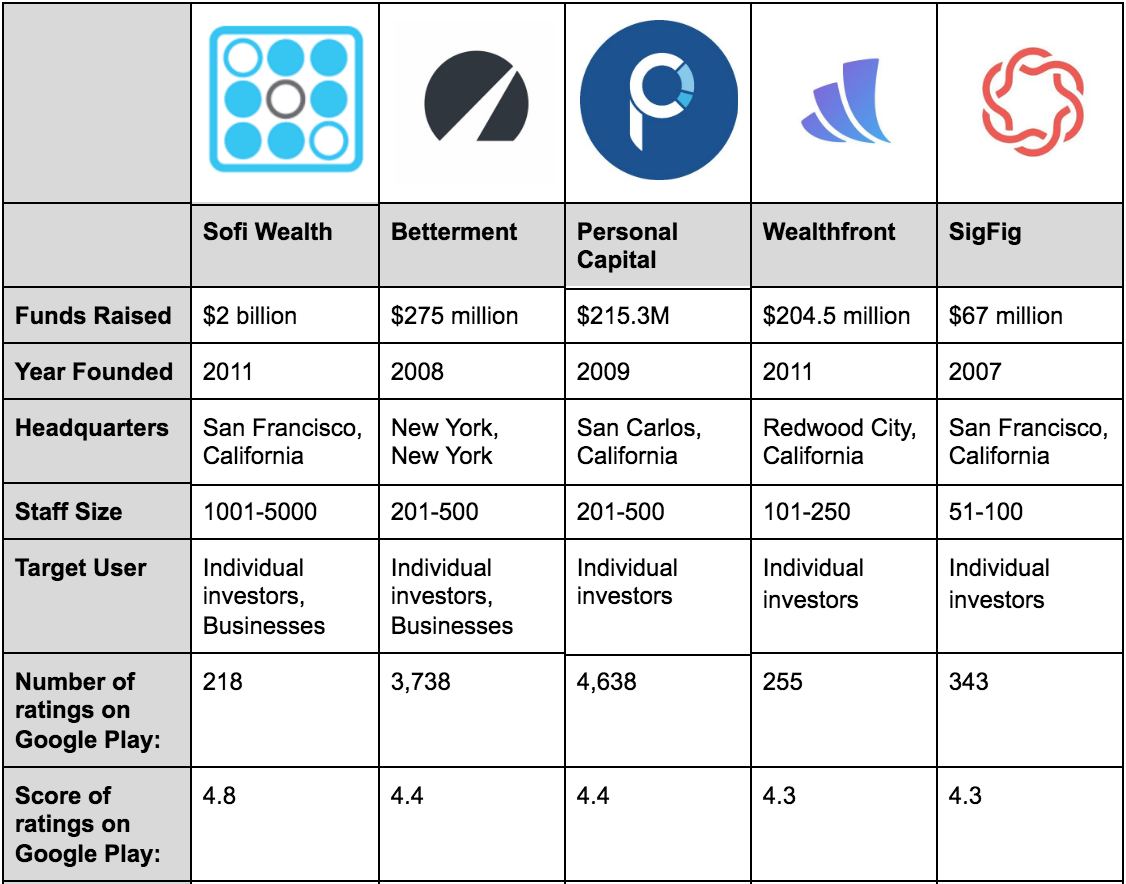

In providing this head-to-head comparison of AI-powered robo-advisors, we aim to provide business leaders with an overview of the artificial intelligence-backed capabilities of five different robo-advisor firms.

(Readers with a more general interest in AI in finance may benefit from our previous article: AI in Stock Trading and Machine Learning in Finance.)

Background: Robo-advisors and Artificial Intelligence

For readers who are unfamiliar with what robo-advisors are, and why they are gaining traction in the market, this short 3-minute overview video from Investopedia is a good, unbiased introduction:

During our research into robo-advisor firms, we were disappointed with how little information was available about where and how artificial intelligence plays a role in these technologies.

The saying in finance is that “money is made in the dark” – in other words – whatever companies are doing to grow and profit will be held as a closely guarded secret. While we expected this kind of secrecy when it comes to the AI applications at large banks or hedge funds, we were expecting robo-advisors to explain the use of AI in their companies well.

This often isn’t the case, and the exact function of artificial intelligence and machine learning at companies like SoFi or WealthFront doesn’t seem to be clear.

In each section below, we’ve explored as much detail as we could about the use of AI at each individual firm. Because companies don’t seem to be complete in their explanations of AI’s role in their platforms, we’ve extrapolated what the companies have said – and what we know about AI and machine learning – to lay out what the process appears to be:

- A user gets an account, hooks in their various bank and investment accounts, and submits their financial goals (say, saving $80,000 for a house down-payment, or saving $500,000 before retirement)

- The robo-advisor provides the user with a balanced portfolio of assets, tailored to the risk profile of the use (i.e. how much downside the user is willing to risk for more financial upside – typically the older a user gets, the more risk-averse).

- In the past, this kind of balanced portfolio or assets (stocks, bonds, ETFs) would have been designed by a human advisor, but algorithms are not purportedly capable of determining an even asset allocation based on the user’s choices

- Some robo-advisors claim to be able to re-balance portfolios (or make targeted suggestions to users) based on the financial standing of the user, the state of the market, or other factors – with the aim of keeping the user on track to reach their goals.

Comparing 5 Current Applications

SoFi

- Total funds raised: $2 billion

- Year founded: 2011

- HQ location: San Francisco, California

- Number of employees: 1001-5000

- Target user: Individual investors, businesses

- Number of ratings on Google Play store: 218

- Score of ratings on Google Play store: 4.8

SoFi originally started as a lending company for student loans, but has since expanded to mortgage financing and refinancing, personal loans, insurance, savings and a robo-advisor called SoFi Wealth. This application is described in the company website as a tool that allows customers to diversify their investment plan, actively manage passive assets, and automatically rebalance investments.

SoFi Wealth invests customers’ money in exchange-traded funds (ETFs), a type of low-cost mutual funds that offers a portfolio of about 20 low-cost indexes rather than individual stocks. The application also helps individuals invest for retirement in instruments such as traditional deductible IRA accounts, simplified employee pensions, and ROTH IRAs.

The application installs on iPad, iPhone and Android units.

None of the company’s executive team members have academic or professional backgrounds in artificial intelligence or machine learning. CEO Anthony Noto served as Chief Operating Officer of Twitter prior to joining SoFI, but his expertise is in finance. On the advisory board is Joe Chen, Founder and Chief Executive Officer of social networking business Renren Inc.

According the Crunchbase, the firm has raised $2 billion in 10 rounds of fundraising from 28 investors.

Betterment

- Total funds raised: $275 million

- Year founded: 2008

- HQ location: New York, New York

- Number of employees: 201-500

- Target user: Individuals investors, businesses

- Number of ratings on Google Play store: 3,738

- Score of ratings on Google Play store: 4.4

Betterment is a robo-advisor that invests and manages individual, IRA, ROTH IRA, and 401(k) accounts for its users.

To join, users answer a short survey about their current investment status, with questions such as if they manage their investments or employ a human advisor, amount invested, and type of investment. They survey also asks about the user’s tax filing status, income, and debt, annual household income, investing strategies. According to the company website, these pieces of information will then be used by the machine learning algorithms to give the user an overview of their financial standing, and enable the application to recommend relevant investments.

Once the customer has created a Betterment account and enlists his or her external account including banking and other investments, the AI is able to provide the user with a view of fees and uninvested cash.

One way AI is purportedly used by Betterment is in reducing taxes on transactions where, according to the company, algorithms select the lots to sell based in part on the tax consequences of the transaction. This method, according to the website, is aimed at improving the tax impact for transactions.

Individual accounts are charged a digital annual fee 0.25 percent on assets, and premium accounts a 0.40 percent annual fee on assets.

Betterment for Business is aimed at enterprises to help employees with retirement savings, using the same principles as the individual version of the application. The algorithm takes into account factors such as where an employee intends to retire and their expected Social Security income.

Pricing for this business plan includes advisory services amounting to 0.25 percent of assets; fund management expenses amounting to 0.10 percent of plan assets; tiered fees for recordkeeping, administration and bookkeeping (First 100 employees: $6 per participant; next 101-500 employees – $5 per participant, additional 500+ employees: $4 per participant). An annual $1,500 is also charged for ongoing guidance.

While all members of the executive and management teams at Betterment are very experienced financial professionals, none of them are presented as AI-focused or having experience in the field.

Personal Capital

- Total funds raised: $215.3M

- Year founded: 2009

- HQ location: San Carlos, California

- Number of employees: 251-500

- Target user: Individuals investors

- Estimated number of current users: more than 1.6 million users

- Number of ratings on Google Play store: 4,638

- Score of ratings on Google Play store: 4.4

Personal Capital developed a robo-advisor that enables customers calculate the user’s net worth, manage investment accounts and taxes, plan for retirement, plan for estate, save for college. To create an account, users must provide each of their external financial accounts and credentials before they can access the dashboard. The customer’s information is stored with Yodlee, a third-party that provides an added layer of security, the company claims.

Once the account is opened, the application gives users insight into their weekly, monthly and yearly income, spending habits, cash flow, portfolio allocations, investments or employee stock options.

Based on these data, the AI projects the user’s spending ability in retirement and suggests options to support the user’s financial goals. For instance, if a user projects spending $7,500 monthly in retirement, but current behavior suggests spending at only $5,000 monthly, the machine learning algorithm will likely recommend a more conservative allocation.

On its website, Personal Capital claims to manage 1.6 million registered users and $7 billion assets in retirement and 401(k)s, estate planning, college savings, and tax management assets.

In the 4-minute video review, the reviewer describes how the app pulls data from the user’s various accounts (input by the user) – banking, credit card, brokerage, retirement, loans, mortgages, among other – and helps track spending, manage investment performance and asset allocation, and scan the user’s portfolio for opportunities to better the asset allocations.

The app received a 4.4 score out of 4,451 ratings on the Google Play store, and more than 100,000 downloads. From the Apple Store, it received an average 4.8 score, from 8,300 ratings but no download numbers are shown.

Fritz Robbins holds the double role of CTO/Chief Information Officer, leading the build and delivery of finance tools and apps for users and clients, and the platforms for advisors while being responsible for enterprise IT, information security, data analytics and data science. He has an MS in computer science from Stanford University.

Wealthfront

- Total funds raised: $204.5 million

- Year founded: 2011

- HQ location: Redwood City, California

- Number of employees: 101-250

- Target user: Individuals investors

- Number of ratings on Apple store: 5,100

- Score of ratings on Apple store: 4.9

Wealthfront is a robo-advisor that enables its customers to invest money, plan a home or for college, save for retirement, or take out loans online. The application is targeted at a wide market such as parents, retirees, young adults, students, personal / mortgage borrowers.

This 1-minute video demonstrates how a customer opens an account by first answering a questionnaire. The technology then uses risk assessment algorithms to determine the level of risk the customer is comfortable, then comes up with individualized plans. The application will require the user to fund the account by fund transfer.

Once registered, the application allows users to connect their 401(k) or IRA plan to this Wealthfront account and monitor portfolio from the dashboard.

Former CEO Adam Nash wrote in a blog post that the AI-powered application uses behavior algorithms to inform the application’s investment decisions. “Observed behavior may reveal insights about ourselves that we aren’t even consciously aware of,” he wrote.

Algorithms are reportedly able to track the user’s account activity and automatically apply that behavior in making recommendations related to diversification, taxes and fees based on the user’s investments, financial profile and risk tolerance. For instance,

- The algorithm tracks the transactions made on the user’s bank account and informs users if they have enough cash in their emergency fund

- By accessing the brokerages listed by the user, the AI could also determine the user’s fund balance.

- The technology will determine if the user is holding too much stock in other accounts and recommend a rebalancing.

- As the user lists their home address, the algorithms will integrate with connected services, provide updates on the mortgage loan, and make financial recommendations to help pay the loans.

Wealthfront claims to charge no financial advisor salaries or trading commissions, and maintains a fee of .25 percent of the account balance.

The company website shows doctorate holders in economics, applied mathematics, management as comprising the Wealthfront executive research team. It is unclear, however, if anyone is focused on AI. Chief Technology Officer David Fortunato does not detail his role on LinkedIn. Principal Data Scientist David McAuley, a holder of an MBA in Quantitative Marketing from the Wharton School, says his role is to improve decision-making with data and the scientific method.

Sigfig

- Total funds raised: $67 million

- Year founded: 2007

- HQ location: San Francisco, California

- Number of employees: 51-100

- Target user: Individuals investors

- Number of ratings on Google Play store: 343

- Score of ratings on Google Play store: 4.3 score

SigFig is a robo-advisor that offers customers investment recommendations, analysis, and tracking from a mobile application or web browser. According to this review of the application, the machine learning methodology uses historical market data to simulate scenarios, make projections, and determine how the user’s investment could potentially perform.

If a user’s investments are performing poorly, the application’s algorithms will purported recommend actions to better reach the user’s goals. From within the application, users can access human advisors through email or live chat, as well as via phone.

In the 4-minute video, CEO and Co-founder Mike Sha claims that the company can integrate the application into a banking partner’s system within 30 days:

Like Betterment, he company claims that its AI engine automatically allocates assets and determines which investments will result in minimum taxes.

Once the user has signed up, the application will be able to analyze their existing accounts.

Users can use this application to link to their IRAs and 401(k) accounts, see which and where brokers are charging too much in fees, areas that are poorly diversified, and suggests ways to improve the portfolio.

Customers can choose to fund the investment through one of three partner brokerages — TD Ameritrade Institutional, Charles Schwab, or Fidelity — which the application can access. It

is also capable of monitoring customer’s investments daily and automatically rebalancing the asset allocation to ensure taxes and commissions are kept at a minimum.

A $2,000 minimum balance is required and no annual fee will be charged on the first $10,000 investment. Funds exceeding $10,000 will be charged an annual fee amounting to 0.25 percent of assets as it requires access to an investment advisor.

An enterprise version of SigFig is also available, which the company claims, can integrate easily into the client’s platform.

On the executive team, CTO Roger Fong who has a Master’s degree in computer science from Cornell University. Before SigFig, he led a team of engineers at Amazon to design and build Amazon’s ordering systems.

Concluding Thoughts

Robo-advisors have definitely disrupted the financial technology sector as more customers grow comfortable having software manage their portfolio with minimal human intervention. At the end of 2016, a press release by Fitch Ratings predicted that all robo-advisors would manage nearly $100 billion in assets by the end of 2016, and further predicts that the assets managed by robo-advisors will post double-digit growth by 2020.

The applications’ AI-powered ability to make financial recommendations, and to automatically invest and rebalance investments is a key factor for its growing popularity, especially among individuals who are new to investing. In addition, the applications offer other conveniences such as providing a centralized view of a user’s entire assets including bank and credit accounts, real estate, loans, brokerages, investments as the technology connects all online financial services the user is enlisted in. Users can access the applications from either an online website or from a mobile phone.

Part of the appeal of robo-advisors is the lower fees and taxes, annual fees usually averaging at 0.25 percent of assets. This, compared with traditional, human advisors and brokers, who often charge at least 1 percent of the assets being managed.

Companies that offer robo-advisor services are not abandoning the human component completely, as they continue to offer the services of human financial advisers. It is often argued that the advantages of human advisors over robo-advisors lies in managing the emotions and feelings of investors. The emotional aspect of money is a key element to risk tolerance, and human advisors serve as the bridge that customers can ask their questions, and ground themselves in sound advice when they might otherwise invest too aggressively or pull too much out of the market.

This is particularly true of enterprises who intend to turn over management of their employees’ tax or retirement plans to a digital wealth management application. It is also likely that high net worth individuals with more sophisticated financial needs will want to seek out human financial experts, instead of having AI manage their assets entirely.

Time will tell if the “personal touch” means enough to the younger generations of investors. The traction of robo-advisors seems to suggest that investors who aren’t wealthy but are digitally savvy may, in fact, be leaving human expertise behind when it comes to investment advice, for better or for worse.

Header image credit: Dell