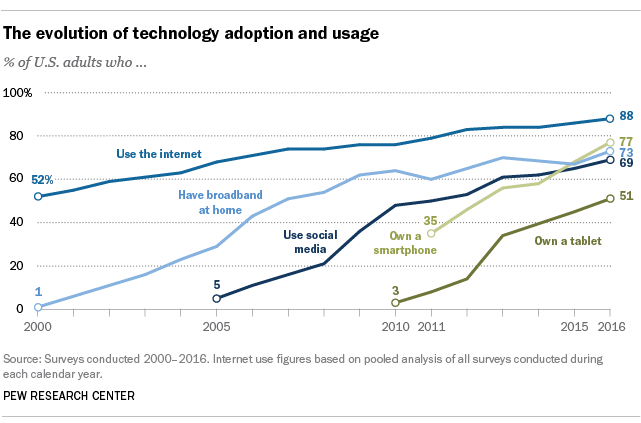

Smartphone manufacturers are trend-setters for innovations in the mobile and consumer electronics space at large. The convenience and integral role of mobile technology in the everyday lives of consumers have contributed to the estimated 77 percent of Americans who own a smartphone. It’s no wonder so many of the smartphone applications we use every day leverage artificial intelligence to improve the user experience.

While smartphones have unsurprisingly saturated the 18-29 age demographic at 92 percent, the gap is starting to narrow among Americans 50 years and older at 74 percent. Approximately 1.5 billion units were sold in 2016, representing a 5 percent increase from 2015.

Industry analysts report that AI is poised to make a strong impact on the global smartphone market which is projected to reach $355 billion in revenue by 2020.

However, no sources have presented a comprehensive look at AI applications among the top selling smartphone manufacturers.

This article aims to provide a succinct picture of the implementation of AI by the five leading global smartphone manufacturers ranked by total units sold and market share in 2016. We’ll aim to answer the following important question about the applications of AI in smartphones:

- What types of AI applications are currently in use and which are in the works among the top smartphone manufacturers such as Samsung and Apple?

- Are there any common trends among their innovation efforts – and how could these trends affect the future of the smartphone industry?

- How much are leading smartphone manufacturers investing in AI?

Through facts and figures we aim to provide pertinent insights for business leaders and professionals interested in how the smartphone business is being impacted by AI. We’ll begin with the largest manufacturer on our list, Samsung:

Samsung

In the competitive AI voice assistant sector dominated by the likes of Alexa and Siri, in October 2016, Samsung announced its reported $214 million acquisition of the open AI platform Viv Labs.

The tech company aims to “deliver an AI-based open ecosystem across all of its devices and services.” Viv is “open” in the sense that it provides “third-party developers” with the ability to build virtual assistants with natural language capability and integrate them into applications and services. Viv’s co-founder and CEO, Dag Kittlaus is one of the creators of Siri.

Samsung has reportedly earmarked at least $1 billion towards AI tech firm acquisitions and has generally expressed that a goal for its products is to be able to anticipate the needs of their consumers. For example, the company acquired Melaud (a smart earphones technology) in February 2017 that may potentially involve AI based on its description. Melaud’s technology can reportedly control music “based on body signals, namely, the heart rate and movements while exercising.”

“Samsung has been focused on integrating AI capabilities to all of its devices and appliances for some time now…the platform that Viv provides will allow developers and service providers to easily onboard their services onto our voice intelligent agent. It will allow us to scale the domain expertise to larger ecosystems.” -Injong Rhee, CTO of the Mobile Communications business at Samsung Electronics

In March 2017, Samsung announced that it was bringing, its own AI-powered personal assistant or “intelligent interface” to market called Bixby. Bixby is an intelligent virtual assistant that is integrated throughout the functions and apps of the Galaxy S8. For example, Bixby can compose text messages from dictation via the voice app, identify landmarks and translate foreign languages using the camera feature or provide reminders and recommendations based on the user’s daily schedule.

However, Bixby is apparently not built by Viv Labs technology but from Samsung’s older S Voice technology. Bixby is integrated into both the Samsung Galaxy S8 and S8+ phone models, the follow-up to the Galaxy Note 7 that was ultimately banned on all flights due to a fire hazard.

Global sales of the Galaxy S8 have reportedly hit the $5 million mark but the U.S. debut of Bixby’s voice feature has been pushed back. Reports suggest that the delay is due to challenges with Bixby “learning English”, converting from a Korean-based language system. Once it gains its footing, it will be interesting to see if Bixby brings innovation and competition to the U.S. market.

Apple

Since its debut in 2011, Siri has become a household name among Apple product consumers and has established a firm position as a leading intelligent assistant. Each month Siri is accessed across an estimated 375 million active devices throughout 36 countries.

However, as the smartphone market grows increasingly competitive it’s no surprise that the company’s R&D budget has steadily increased over the past few years to $10 billion in 2016; its highest allocation to date. Apple acquired Lattice Data (a data analytics technology firm) for $200 million in May of 2017.

The iPhone has recently experienced flat sales, and reports have circulated that Apple Inc. is looking to integrate AI across its devices through the design of an AI chip “known internally as the Apple Neural Chip.” Examples of possible applications include “offloading facial recognition in the photos application, some parts of speech recognition, and the iPhone’s predictive keyboard to the chip.” The company may also offer “developer access” so third-party apps could access the chip’s capabilities for AI related tasks.

In fact, chip design has been integral for the brand. Interestingly, Google recently hired Apple chip architect Manu Gulatti as its new lead SOC architect. Considered an expert in microchip design, during his years at Apple, Gulatti played an important role in building the custom chips for the company’s top products including the iPhone.Since Apple introduced the iPad powered by the A4 chip or SOC (system on a chip), the company has been using custom-designed microchips for its devices.

While the timing of the hire may or may not directly correlate with a growing awareness of Apple’s interests in AI, it does suggest Google wants a competitive edge as it rolls out its own AI strategy.

“…Google must and will increase the reach of its own Assistant to all Android smartphones—reducing the differentiation for Google’s Pixel smartphone. Over five years since Apple’s Siri first launched, Apple must offer new AI-powered capabilities to remain competitive.” – Ian Fogg, Director of mobile and telecom analysis at IHS Markit.

While it is unclear at this time when the “Neural Chip” may surface or exactly how the AI acquisitions will affect consumers, it is clear that Apple understands that in order to keep its competitive edge it will have to strategically integrate AI throughout its brand.

Huawei

Huawei introduced its Mate 9 smartphone to the U.S. market in January 2017. The smartphone processor that powers the Mate 9 is Huawei’s Kirin 960 chipset. The chipset itself has reportedly sold over 100 million units and uses a machine learning algorithm and stores data locally which reportedly delivers reliable performance for running tasks without lagging after months of continuous use.

One of Huawei’s goal is for their smartphone to achieve a more efficient performance than competing brands by being able to accurately anticipate user activity. The Mate 9 retails for $600 and is also the first smartphone model to come pre-installed with Alexa, Amazon’s cloud-based voice assistant.

Mate 9 users can access Alexa using voice commands to assist with activities such as online shopping and operating home appliances. However, there are limitations and Mate 9 users must manually open the app first to start communicating with Alexa instead of having the option of activating Alexa with a voice command.

“Huawei introduced Mate 9 during the quarter — within a month of Samsung discontinuing the Galaxy Note 7 — which was good timing to position it as an alternative.” – Anshul Gupta, Research director at Gartner

Just a month before the Mate 9 was officially unveiled at the Huawei Global Product Launch in Munich, Germany, in October 2016 the company announced a strategic partnership with UC Berkley focused on AI research.

Huawei is providing the university with $1 million for this research endeavor. While the specific desired outcomes of the partnership are unclear, Huawei’s R&D team will collaborate with the Berkeley Artificial Intelligence Research (BAIR) Lab and areas of interest include “deep learning, reinforcement learning, machine learning, natural language processing and computer vision.”

As of June 2017, no specific announcements of research outcomes of the collaboration have been released. Huawei’s Noah’s Ark Lab has also designated a segment of its research to machine learning. Over the last decade Huawei has invested over $38 billion in R&D, however the company does not publicly itemize how the funding is allocated, and so it is difficult to discern the priorities of it’s AI developments.

The Top Chinese Manufacturers: OPPO and BBK Communication Equipment

OPPO is among China’s leading smartphone manufacturers, which together represented an estimated 19 percent share of the global smartphone market in 2016, according to Gartner.

Established by BBK Electronics, OPPO is a subsidiary through which its parent company markets different cell phone brands. In 2016, OPPO and BBK held the 4th and 5th positions among the top-selling global smartphone manufacturers.

While there is no evidence to suggest that OPPO or BBK are currently integrating AI in their smartphones, rumors have been circulating around OPPO’s next smartphone model.

The OPPO Find 9, the reported successor to the OPPO Find 7, was originally anticipated to be released around March 2017 and is rumored to be built using a variant of android known as Find OS, based on AI.

Images and specs of the phone have been leaked on the internet but the company itself has not confirmed an exact release date or if their next smartphone will indeed feature AI functionality. As OPPO and BBK continue to encroach upon market territory dominated by the current top three smartphone manufacturers, it is very likely that we will see AI applications factor into the design of their future smartphone models. As voice commands and machine vision applications become essential elements of the phone interface, there will be increasing pressure for China’s manufacturers to stay ahead of these trends.

There is reason to believe that Asia in general – and China in particular – may develop smartphone AI capacities faster than in the United Stated. In our interview with Dr. Adam Coates (Baidu’s director of the Silicon Valley AI lab), he mentioned that the following factors will likely contribute heavily to AI’s developments in China:

- Many smartphone users in China have never used a desktop (they are “mobile first” users), and so all the tasks that Western consumers might wait to do when they get home to their desktop must be done on mobile with many Asian users

- Chinese characters are challenging to type on a smartphone keyboard, so speech recognition and other gesture commands are in much higher demand

- China has many more smartphone users than the United States, making for a wide availability of data from app interaction, speech data, and more. This also creates tremendous economic incentives for companies developing apps and AI products for Chinese smartphone users

With these important cultural and technical forces at work, it will be extremely challenging for major consumer hardware providers to compete without allowing for a robust suite of AI solutions (whether through apps or through some kind of proprietary cloud intelligence – such as Siri or Google Now).

Concluding Thoughts on AI in Smartphones

It is no coincidence that leading smartphone manufacturers are integrating intelligent virtual assistants into their latest smartphone models. Industry analysts expect the intelligent virtual assistant market to surpass $11 billion by 2024. Business leaders should consider that their customers will be directly impacted by the growing influence of AI in the smartphone and general mobile technology sector. The race to create the ubiquitous personal AI “genie” is a business has the potential to being a winner-take-all game.

As intelligent virtual assistants learn and gain a deeper understanding of what functions and applications are most important to their human users, overtime, customers will grow to expect the convenience that these assistants can provide and will gravitate towards businesses that offer similar conveniences. We’re already seeing similar trends in major industries such as the banking industry with applications of AI assistants and chatbots, which (similarly) have started with the industry’s largest players, but may soon become near-ubiquitous customer expectations.

Samsung and Huawei (and potentially Apple) are currently following a trend of making smartphone intelligent virtual assistant functions accessible to third-party apps. This means that businesses that are ready to take advantage of this option are well-positioned to strengthen and expand their customer bases.

Time will tell whether proprietary AI capabilities (Siri) or an ecosystem for AI app development (as Amazon is doing with Alexa’s “skills”) will lead to the greatest advantage in the market, but both of these paths are likely to be explored by all intelligent consumer hardware-makers. Readers with a keen interest in this sector should keep a close eye on the AI chip developments at these major smartphone firms.

Image credit: TechWeez