AI could play a major role in the way European insurers do business going forward. It may provide insurers new methods for collecting customer data that offer valuable insights insurers can use to attract and maintain customers.

That said, although the European Union’s recent implementation of the General Data Protection Regulation (GDPR) puts them in a unique position around the world with regards to machine learning innovation going forward, home and auto insurers are likely able to work around the regulation fairly easily because neither of them requires large amounts of personal identification information to do business; this is perhaps less the case for life and health insurers. Those insurers could find it harder to implement machine learning systems into their business in ways that both provide them a competitive advantage over their competitors and save on resources.

This is because clean data is necessary for training an AI system to improve its accuracy enough to make it useful. Without enough data, the system won’t be able to learn nearly as quickly.

The GDPR regulates “any automated decision that ‘significantly affects’ EU citizens. This includes techniques that evaluate a person’s ‘performance at work, economic situation, health, personal preferences, interests, reliability, behavior, location, or movements.”

This kind of information is the external data insurance companies could use to create policies tailor-made for their customers as well as to speed up and partially automate the underwriting process, providing the customer with a quicker purchasing experience and saving the company on time spent determining a customer’s risk.

According to a paper by the Brookings Institution, the GDPR amounts to the European Union “putting its manufacturers and software designers at a significant disadvantage to the rest of the world.”

That said, AI could still prove valuable to some European insurance companies in the near future, and with the state of the GDPR likely to change over time, forays into AI are certainly not futile for EU-based insurance companies.

In the US, companies like State Farm, Allstate, Liberty Mutual, and Progressive have already begun to implement AI into their businesses with methods for training agents and IoT devices used to provide customers with discounts for less risky behavior. Although popular discussion about AI often involves how blue-collar workers may be at risk of losing their jobs to the technology, white collar works may also feel concerned for their job security, and there are some responsibilities for which AI could replace white-collar workers such as insurance agents.

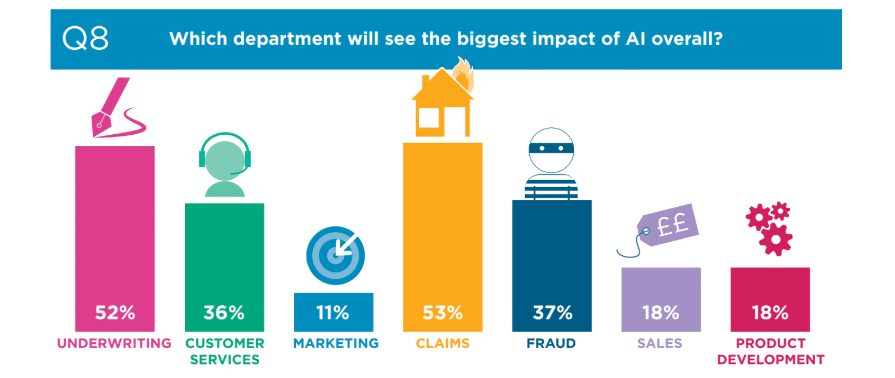

Insurance Nexus conducted a survey of 250 insurers in their Advanced Analytics and AI Survey, which looked at the sentiments insurers share with regards to AI in their industry. In this article, we explore some of the results regarding two questions on the survey:

- Which department will see the biggest impact of AI overall?

- Which department is most under threat from jobs being lost to AI?

Paraphrasing in this article is from Alessandra Chiuederi and Roger Lewis came from an Insurance Nexus webinar titled The Next Frontier for Insurance: Transcending Performance With Intelligent Automation – Download the full white paper here.

Which Department Will See the Biggest Impact From AI Overall?

The graphic below depicts the percent of insurer respondents who believed that AI would have the most impact on different departments within the insurance industry. Note that these results represent the sentiments of insurer respondents and not an actual measure of how AI will in fact impact industry departments.

Just over half of insurer respondents believed that artificial intelligence would impact how customers file claims above all else. This makes sense; there are already numerous use cases regarding how AI can help handle insurance claims. In a webinar with Insurance Nexus, Alessandra Chiuederi, head of the Analytics Solution Center at Generali, claims that some AI software can play a role in analyzing documents to ensure they have been signed, completed, and validated when it works in conjunction with a robotic processing automation system; together they can also flag documents that are set to expire.

Chiuderi also suggested AI could potentially be used to automate payouts to customers by recognizing the treatments they receive. For example, AI software could read that a customer is undergoing a specific combination of chemotherapy and automate payment to the customer based on that customer’s policy and the specific mix of drugs used for their treatment.

Automation like this could potentially save companies on customer service costs by reducing the number of phone calls they receive from customers looking for their payments, and it could improve the customer experiencing by ensuring their timely payment.

In a similar vein, Chiuderi claims that AI software could analyze the images associated with a claim. To do this, the AI would have to comb through a database of historical images of a similar kind. For example, an AI system could potentially assess a vehicle’s damage after analyzing numerous other images with damage of similar severity, and, based on historical data revealing how much is usually paid out to customers with damage of that severity, it could generate an appropriate payout.

Tractable claims that their AI software can do just that. In addition, they claim it can also flag claims as potential fraud by checking the images attached to those claims against those used in other claims to see if there is any direct overlap, as previously described. To do this, Tractable says their AI can connect to the back offices of insurance companies, although the way they do this (and exactly what this means) is not entirely clear.

With so many use cases, it makes sense why more insurers believed AI would have the biggest impact on claims more than any other department in the industry.

Underwriting

Ranking just below claims, 52% of insurer respondents believed AI would impact how insurance companies underwrite more than any other area in the industry. In a webinar with Insurance Nexus, Roger Lewis, Chief Underwriting Office at NN Group,

suggested that insurance companies could use AI to aggregate internal data (that which is about the customer themselves) and external data (public records, social media, proprietary data, data from IoT devices, etc), allowing companies to theoretically assess a customer’s risk more accurately.

Traditionally, insurance companies had only historical data to go on when determining a customer’s risk: Their blood pressure, their weight, their family history of illness. External data could help provide a more complete picture of a customer, allowing companies to more confidently underwrite on larger amounts. For example, customers with certain kinds of social media posting patterns (or content within those posts) may be deemed to be a higher or lower insurance risk.

Insurance companies that do the majority of their sales online will have an easier time implementing AI for external data collection into their businesses due to the much greater ability to track customer behavior online. Companies can collect data on the searches and purchases that customers make to better inform a profile of the customer and their lifestyle, thus allowing underwriting AI software to better assess a customer’s risk.

Fraud

37% of insurer respondents believed that AI would impact the way companies handle insurance fraud more than any other area. Chiuderi claims Generali’s AI system (in production at the time of writing this article) might be able to run the images associated with a claim against caches of images both within and outside of the user company to determine if it appears in another claim. In the event that it does, the system might flag the entire claim as suspicious.

Insurance companies could also potentially use machine learning algorithms to better understand customer patterns through IoT devices, such as a dashboard sensor that can monitor a customer’s driving habits. In doing so, the AI system could create a unique customer profile that theoretically could be used to flag claims as identity theft by recognizing a change in that customer’s pattern.

Shift Technology is a Paris startup that claims to leverage AI for fraud detection and claim automation. They claim that their Force system has handled over 78 million claims as of last year, and in one use case for Spain-based Direct Line insurance, they claim it accurately identified fraud in 75% of the cases it processed that ended up being fraud. Direct Line insurance later decided to adopt the Force system into their regular fraud detection practice, especially considering they claim that 6% of insurance claims in Spain are actually fraudulent.

Technology such as this could provide insurance companies with an additional tool to combat insurance fraud. According to the Coalition Against Insurance Fraud, insurance companies pay out on fraudulent claims worth a collective $80 billion a year.

Customer Support

According to Insurance Nexus, 36% of insurer respondents also believe AI will have the greatest impact on the customer support side of the insurance industry. Perhaps most recognizable, companies might implement chatbots that could allow customers to purchase insurance and get their questions answered virtually, saving companies on call center costs and customers on their time.

Chatbots might also be able to recognize and remember customer faces, tailoring the messages they send to specific customers. Additionally, AI software could speed up identity verification, allowing insurance companies to more quickly provide prospective customers with quotes or seal the deal on their purchase.

Last year, life insurance startup Lapetus began offering customers the ability to purchase life insurance with only a selfie—no medical exam required. They claim their Smoker Indication and Lifestyle Estimation can predict if a person smokes or not; user companies can then offer the potential customer a quote to reflect their lifestyle. This could, in theory, improve customer loyalty due to the convenience.

Sales and Marketing

Insurance companies may also implement AI to improve sales. One such way they could do this is by way of chatbots, automating the buying experience and providing customers quick access to purchasing insurance for specific situations relevant to them in the moment.

Insurance companies with multiple plans or with plans in numerous insurance industries (auto, life, etc.), may benefit from recommendation engine applications like those customers find on Amazon. These engines could possibly present customers with additions to their current plans based on their search history, demographic information, claim history, family status, budget, and other factors.

Alternatively, an AI algorithm could upsell recent customers—possibly within moments of purchase—based on those same criteria. This could boost insurance sales and in theory increase customer loyalty due to the convenience of a company’s website.

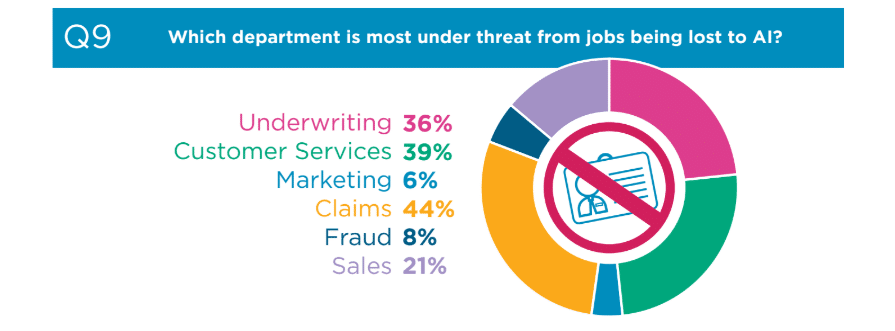

Which Department is Most Under Threat From Jobs Being Lost to AI?

Although there are numerous examples of use cases for AI in insurance, they may or may not be to the benefit of insurers themselves. Although the likelihood of replacement is low in the near term, insurers may be worried about someday finding less security in their industry, especially in departments where machine learning-based automation is much easier to implement. At this point in time, AI mostly serves a function as a tool. Insurers could leverage it to decrease the time they spend on certain tasks in order to make time for other, possibly more strategic ones.

That said, insurers in some departments are wary of too much automation. Some of the departments which insurers believe might be at risk for layoffs, according to Insurance Nexus’ survey, are discussed below.

The graphic below depicts the percent of insurer respondents who believed that a given industry department would meet competition from AI. Again note that these statistics are measures of insurer sentiments, and so are from an industry perspective, not from the perspective of AI experts or researchers.

Claims

44% of respondents believed that those in the claims department are the most likely to face competition with AI for their careers, 9% less than the percent of respondents who believed AI would impact the claims department most. Again, Insurance Nexus’ study provided no insight into why this discrepancy exists, and, perhaps noteworthy, why the discrepancy is so much lower than that for underwriting (discussed below), but it may be due to the more recent proliferation of information regarding machine learning chatbots and machine learning for image identification.

Last year, insurance startup Lemonade reportedly paid a customer’s claim in just 3 seconds. How? Their AI-powered chatbot—his name is Jim—responded to a customer’s text message and approved the claim within minutes. The customer was purportedly paid just 3 seconds after approval. It should be noted, however, that the customer made a claim for a more than $900 coat that was stolen, and so the claim was one for product insurance. Lemonade themselves admit that Jim can’t handle more complex claims and that such claims are elevated to “real Jim.” Although at this time chatbots in general probably cannot handle more complex and nuanced claims, it’s possible that simple claims may not require human labor.

Machine learning software may also be able to comb images attached to claims, such as those showing car damage, personal injuries, or x-rays. It could theoretically identify the severity of the damage or injury on which the customer is seeking to file a claim, and, in doing so, it could determine the appropriate payout for the customer (or help to inform the claim “range” for a human claims examiner).

Of course the number and kind of images the AI is trained on over time will affect the accuracy of this evaluation and thus the accuracy with which appropriate payouts are made, and so firms without access to histories of images may want to avoid automating payouts until they build up enough of an image backlog to ensure a more accurate AI software.

It’s likely that the algorithm will present a confidence score for its findings, automating claims which it is confident about (say, about 95% confident), and which are below a certain dollar value (say, $20,000). At this future time, human claims representatives might still be necessary for some businesses when they come across niche cases, such as an extremely rare disease.

Underwriting

Interestingly, although 52% of insurer respondents believed that AI would impact underwriting the most out of any area in the insurance industry, only 36% of them believed that underwriters were at the most risk for losing their jobs to AI. Insurance Nexus’ study does not offer insight into why this discrepancy exists; it’s possible that a large number of the 250 respondents were underwriters themselves who in the moment of their response wanted to avoid thinking about the prospect of losing their job, but we simply don’t know.

That said, however, we actually believe that of all the important insurance occupations, underwriters are possibly among the most likely to face competition with AI for their jobs. This is due to the nature of the underwriting process. A machine learning software could comb through customer history data: your driving record, your medical records, your height and weight, your history of drug use, your age.

Since each of these is a data point that one could feed into a machine learning system with relative ease, it could churn out a reasonably accurate assessment of risk for the company, thus automating the scrutiny and evaluation process underwriters do for their careers.

Fraud

Although fraud detection is a classic problem for machine learning algorithms to tackle, interestingly only 8% of insurer respondents believed the fraud department was under threat of job loss as a result of AI integration. This is notable due to the discrepancy between this statistic and that which showed 37% of insurer respondents believed AI would have the most impact in fraud detection. We can less clearly conjecture on the reason for this seemingly significant discrepancy as there are numerous use cases for machine learning in detecting fraud.

In a way combining the uses for AI in underwriting and claims, machine learning algorithms could pick up on customer patterns and habits from their driving to their spending and then check individual customer events to that pattern, flagging unusual events as fraud. Similarly, AI systems could check images attached to claims against images in historical databases to ensure that the same image hasn’t been used for multiple different claims.

Perhaps insurer respondents had in mind, rightfully so, that an AI would not be able to take the next steps after flagging a claim as fraud: Reaching out to a customer to sort everything out. In some cases, AI would be unable to determine why a case may or may not be fraud. If the customer event does not match their unique pattern, the AI flags it as fraud; if the claim image matches the historical database of images, the AI flags it as fraud.

Customer Service

As for customer service, although chatbots are nowhere near the capability of engaging in a true conversation with a customer, they may be able to answer simple customer inquiries. They could perhaps provide customers with a list of plans or call-and-response style ask customers questions to inform the machine learning algorithm that would pump our a quote for them. 39% of Insurer respondents believed customer service jobs had the highest threat of AI replacement, perhaps due to press surrounding chatbots. As mentioned above, chatbots could help pay customer claims faster, but only simple claims. Altogether, nuanced interaction with a customer is at this point most likely best left to human representatives.

This article was sponsored by Insurance Nexus, and was written, edited and published in alignment with our transparent Emerj sponsored content guidelines. Learn more about reaching our AI-focused executive audience on our Emerj advertising page.

Header Image Credit: Tech.eu