Insurers have been long aware of the perfect storm of converging market trends pointing to the permanency of digital disruption and change. Yet, the industry – especially the big players – always seemed to move their collective house further away from the shoreline.

Then the COVID pandemic appeared, resulting in chaos inflicted on the global economy and working models, and feigning ignorance was no longer an option.

In a 2021 KPMG survey of insurance CEOs, 85% attributed the COVID pandemic to their company’s digital transformation and “next-generation operating models.” 79% state that the pandemic accelerated the creation of a digital customer experience.

The insurance space also remains hampered by legacy systems and their consequent costs. In a 2021 report by KPMG, “legacy systems” was named the second most significant obstacle to operational efficiency (data security and privacy concerns were the first).

Buyer preferences and accelerated digital adoption demand a digital-first business model. We are already witnessing this paradigm shift. PwC reports insurance technology (or ‘insurtech’) startup funding as a critical indicator of disruptive innovation in the sector, growing to $15.4 billion in 2021, according to an industry report by CB Insights – a YOY growth of 90 percent.

The prospect of positive business outcomes through lower costs, enhanced productivity, better decision-making, and more satisfied customers all drive AI investment in the insurance space. From these observations, this article will explore two related, widespread industry trends:

- Insurer demand for AI-enabled third-party services is increasing

- AI continues to innovate claims processing

These trends are producing insightful AI adoption use cases in the following areas, which we will summarize following an analysis of each requisite trend:

- Automated pricing optimization: Training algorithmic models on insurer customer data using machine learning and predictive analytics to improve the speed and accuracy of the product pricing modeling process

- Claims processing: Reducing costs using computer vision, optical character recognition (OCR) and machine learning to process more claims weekly per adjuster.

We begin this article by laying out and discussing leading industry trends in further detail.

AI Adoption Trends in Insurance

We first look at the trend of insurers’ demand for third-party AI-enabled services and utilities. This trend has its origins from the start of the pandemic as insurers raced to implement their digital strategy.

Trend 1: Insurer Demand for AI-Enabled Third-Party Services is Increasing

Unsurprisingly, traditional insurers are reaching out to more tech- and AI-savvy counterparts for help with their digital transformation. Partnerships with insurtechs and other tech-savvy firms are helping many players within the industry to create new tools and models.

The growth of insurtech is proof of demand. As stated prior, the funding of insurtech firms grew by over 90% from 2020 to 2021 – a massive increase for any industry.

Insurtech companies exist to offer insurance companies and brokers efficiency and value, particularly in administrative, distributive, and creative tasks. Insurtech companies aim to combine industry knowledge and technological expertise in producing solutions that enhance efficiency and add value – especially solutions involving data science and AI.

Insurtech is fundamentally altering essential functions within insurance, including those related to actuarial and underwriting. Instead of tedious modeling tasks, domain experts – including actuaries and underwriters – can spend more time understanding the problem and applying the right solution.

In turn, insurance companies are partnering with firms that specialize in AI or AI-enabled technologies, such as:

- Computer vision

- Machine learning

- Predictive analytics

- Natural language processing (NLP)

As a result, the insurance sector is seeing a wide range of use cases utilizing the AI capabilities mentioned above, including:

- Accelerated claims processing

- Claim fraud detection and prevention

- Customer support

- Policy pricing and underwriting

- Prediction of customer churn

Use Case #1: Automated Pricing Optimization

Akur8 is a startup specializing in AI-based SaaS insurance pricing products. The company is based in Paris, France, and services insurers from the major European markets. U.S., South America, Singapore, and China.

The company offers a solution called Transparent AI, which they claim on their homepage can help all non-life insurance companies improve the speed and accuracy of the product pricing modeling process using machine learning and predictive analytics.

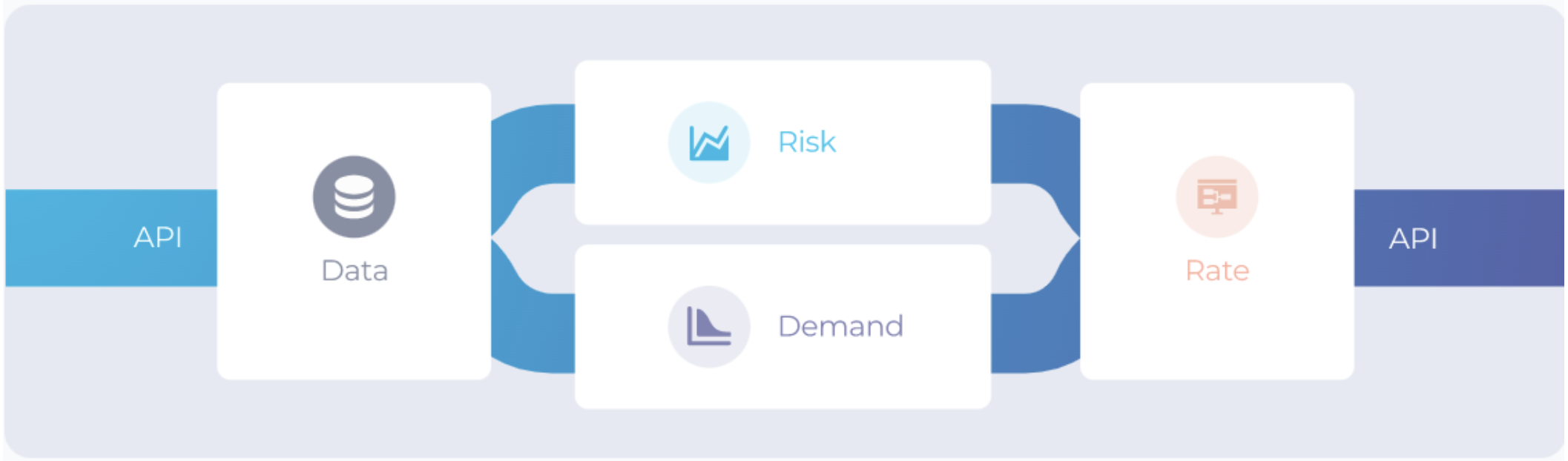

Based on the workflow presented in available public information from Akur8, the model works with insurer customer data via API integration and runs them through its proprietary algorithms.

That modular modeling workflow includes the following segments via the Transparent AI dashboard (with a video link for risk and demand modules) and the following example input data:

- Risk module: “to build technical models and pure premiums.”

- Driver data: age, gender, duration of vehicle ownership

- Vehicle data: max speed/acceleration, year, age

- Contract data: # of payment delays, # of claims submitted last year

- Demand module: “to build behavioral conversion and retention models and measure price elasticity.”

- Coverage data: coverage type, premium loss ratio, previous insurer.

- Driver data: The number of years in vehicle ownership, years insured, driving license age (apparently, the age at which the license was bestowed), the number of kids on board.

- Contract data: Contract mileage (number of miles the contract covers), ratio with the best price (apparently, the percentage difference between the current premium price and the cheapest).

- Behavior-pricing bias controls: Disassociate conversion rate from price sensitivity modeling (optional)

- “Impact analysis” KPIs

- Average premium price offered vs. price written

- Combined ratio

- Conversion rate

- Expected loss ratio

- Gross written premium

- (Profit) Margin

- Rate module: “to iterate on rate plans (commercial premiums) and run portfolio analyses” (less specific data for this module.)

- Adjustment of final policy/coverage rates

- Statistical methods

- Conversion/retention analysis

- Apparent A/B testing (e.g., price increase/decrease and the number of policies sold.)

- Visualization and reporting capabilities and outputs.

Screenshot 1: Transparent AI simple data workflow (Source: Akur8)

Below is a video of approximately 3 minutes demonstrating how Transparent AI works:

The company claims the average results across all clients:

- Time spent modeling is reduced by a factor of 10

- Model prediction accuracy increased by 10%

- Loss ratio improvement of between 2-4%

Trend 2: AI Continues to Restructure Claims Processing

Insurance companies must walk a fine line when it comes to claims processing. On the one hand, they must be sympathetic to the situation and seek to resolve the claim quickly and with minimal stress for the customer. Conversely, the insurer must safeguard itself against litigation risks and fraud while controlling costs.

AI is making it easier to accomplish these goals via mobile applications that provide advantages to both client and insurer in what is traditionally considered, at worst, a bureaucratic and impersonal operation.

AI-enabled straight-through claims processing, in particular, along with new mobile apps and virtual appraisals, represents a new wave of AI innovations contributing to the evolution of claims processing. Some of the tangible benefits realized through these data sources include:

- More accurate claims payouts

- Reduction of human error in FNOL

- Expedited claims processing

- Reduction of fraudulent claims

New and evolving data sources are also contributing. Examples of these newer data mediums include:

- Agent-client interaction data capture (e.g., from emails, chats, etc.)

- Cloud integration (more storage of customer data)

- Telematics

- Sensors

- IoT devices

- Social media

Use Case #2: Claims Processing

Nuvento is an AI-centric business intelligence and software company based in Lenexa, Kansas. The company offers a solution called NuOCR, which the company claims helps businesses with document digitization and end-to-end information management using computer vision, optical character recognition (OCR) and machine learning.

The company states on the NuOCR product page that the solution integrates with the client’s database. The product is available for download on the Microsoft Azure marketplace.

The NuOCR solution follows a workflow similar to other document and data processing techniques involving a large degree of automation augmented by limited, usually signle-digit points of human intervention and oversight in the system at high-level stopgaps. That workflow proceeds as follows:

- Template selection: The user chooses from either a pre-built template from a library or uploads their own. Manual template selection allows users to annotate data field names (see video below).

- Form/file upload: The user uploads the forms/file as a scanned document, image, or PDF file.

- Quality check: The software analyzes the document for quality.

- Data extraction: The software then identifies and extracts document data.

- User verification and editing: The user is presented with a “Result” page where they can validate the solution’s extractions and make edits if necessary.

- Output: The user saves the template to their database or exports the data as a CSV file.

The following nearly four-minute video demonstrates NuOCR capabilities:

In one use case, Nuvento purports to have assisted third-party claims adjusting (TPA) firms in automating their process. Per Nuvento, the TPA process required manually extracting “thousands of claims” received weekly into data processing systems.

Before implementing its solution, Nuvento states in the online case study page that the TPA relied on multiple manual processes, including:

- Checking emails for claims submissions

- Entering claims data into data processing systems

Nuvento states that processing an inbound claim would take the claims adjuster an average of 18 minutes, resulting in an “annual productivity loss” of $14,000 per year per adjuster. The TPA firm approached Nuvento for help improving its operational efficiency and lowering the overall cost of claims handling.

Also according to Nuvento, they created a customized solution capable of scanning incoming emails based on system parameters. NuOCR would extract the required data from the attachments, which were then fed into the client’s processing systems for analysis.

Nuvento claims the following results for its client:

- 60% reduction in overall cost

- 3000 additional FNOL forms processed weekly per adjuster