The last few years have yielded a tremendous amount of attention at the intersection of AI and healthcare, from DeepMind’s partnership with the UK’s National Health Service to IBM’s continued pushes into areas of genomics and drug discovery. From the perspective of healthcare executives, however, many important questions are left unanswered and rarely addressed in detail:

What difference are healthcare’s machine learning innovations likely to make in the lives of patients?

What disruptions should healthcare executives prepare themselves for now?

How will the healthcare industry operate differently in 5 or 10 years into the future?

We surveyed over 50 executives of healthcare companies leveraging AI. We aimed to do the hard work of separating the companies actually applying AI from those who use it as a buzzword (over 15 of our initial survey responses were turned down due to lack of evidence of real AI in use), presenting important predictions and industry insights in clear and interactive charts and graphs.

The following research article is broken down into five sections:

- “Highlights” of some of the most important findings in our executive consensus study

- Directions on how to read and explore our research

- Complete list of written insights and interactive graphics

- List of participant companies

- Related machine learning in healthcare resources from Emerj

Research Highlights at a Glance

We realize that not all readers will have the time to explore each of our charts and graphs in detail, so we’ve extracted what we consider to be the five most important research insights :

- Broad Scale AI Adoption by 2025: Over 50% of respondents believe that AI will be ubiquitous in healthcare by 2025. On an open-ended question, over 25% of respondents stated that they believe that AI will be nearly ubiquitous in healthcare setting by 2025.

- Dire Need for AI Healthcare Case Studies: Nearly 50% of US companies believe that the healthcare industry “needs to be convinced further of ROI from AI / ML investments”.

- Decision Support Systems to Improve Patient Care Come First: “Decision support systems” was ranked as the most likely application to be improved by AI (for improving patient outcomes), with an average 4.15 score on a 1-5 scale.

- Hospitals Purchase Mostly by Patient Outcomes and Financial Efficiencies: “Improving Health Outcomes” was rated as the factor of highest importance in getting a customer to buy an AI product, rated a 4.2 on a 1-5 scale. “Saving Money” was rated a close second with a 4.1 score. Most other reasons rated as significantly less meaningful in closing healthcare deals.

- AI’s Near-Term Focus Will be Improving Chronic Conditions: “Chronic Conditions” was listed in nearly one-half of responses when execs were asked to predict patient care improvement across ailments. Of the specific conditions mentioned under “Chronic Conditions”, “Diabetes” topped the list at nearly 30% of the mentions. “Cancer” was less popular, and was listed by slightly over one-third of respondents.

Continue reading for full detail on our findings:

How the Interpret the Research Findings, Charts, and Graphs

The research below is broken down into 10 sections of insight, each of which includes:

- A chart or graph representing the visual data, often with interactive “segments” that readers can click to explore

- A “Noteworthy Insights” section that highlights the key findings of each section

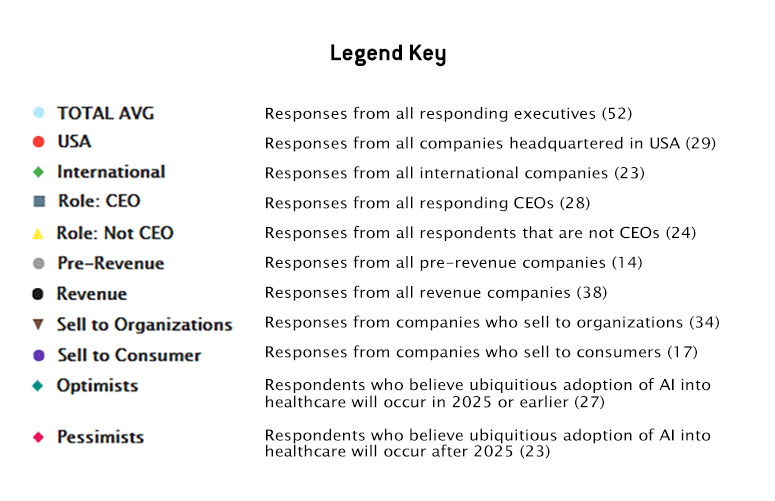

Most of our charts and graphs allow readers to explore the data actively though different participant “segments” or sub-sets (such as USA-based companies, companies who sell to consumers directly, or pre-revenue companies, etc). We’ve used the legend key below to visually differentiate between segments of respondents who participated in this survey:

How to Use Our Interactive Chart Views

We set out to make our data sets insightful and easy to explore for our business audience.

In the charts and graphs below, individual respondent “segments” (such as “Companies that Sell to Consumers”, “Companies Based in the USA”, “CEOs”, etc.) are listed at bottom.

When these segments are clicked, they disappear or reappear on the chart. Readers who want to look at the difference between “USA” and “International” companies, can simply de-select the other segments by clicking on them, leaving only the different response scores from the “USA” and “International” segments; this makes it easy to see where the two groups diverge in their predictions.

Below is a 10-second animated gif that demonstrates the selection and de-selection of segments, allowing for easier comparisons of differences and similarities amongst respondent groups:

In addition to selecting and de-selecting segments, readers can hover over specific data points in each chart to see exact numbers and percentages per segment response (this “hover-over” effect is visible in the gif above).

Full AI in Healthcare Executive Consensus

Demographics of Companies and Respondents

The above data gives a good overall picture of which kinds of executives and companies participated in this round of our machine learning in healthcare consensus research. We advise readers to hover over the different bar graph segments to learn more about each demographic element (specifically “job function” or “revenue status”). Most of the companies we surveyed are indeed still “startups”, as this was the focus of the consensus. It’s important to note that only a handful of large organizations could be called “pure AI-healthcare companies” in what is still an emergent field.

Demographics of Companies and Respondents – Noteworthy Insights:

- About 35% of the companies polled reported annual revenues over $1MM, about 38% reported generating annual revenue under $1MM, and the remaining 27% reported being “pre-revenue” at the time of this survey

- About 55% of respondents surveyed are employed by US-based companies

- Over 50% of our respondents were CEOs or presidents of their respective company

Product Offering Breakdown

About 60% of the companies surveyed sell primarily to organizations and other companies, while about 40% have most of their sales efforts directed to consumers.

Product Offering Breakdown – Noteworthy Insights:

- 35% of surveyed companies with SaaS offerings (sold to organizations) are focused on improving diagnostics, including many companies with a focus on medical image analysis. Diagnostic applications represent the most popular SaaS offering from our surveyed companies, a trend that is likely to continue as the field develops.

- About 24% of surveyed companies with SaaS offerings are focused on improving operational efficiency for hospitals, including applications to help with financial collections, patient scheduling, and other uses. “Operational” applications were second only to diagnostic applications in terms of popularity.

- 29% of straight-to-consumer apps are built for behavioral adherence (such as exercise encouragement, reminders for taking medication, etc.), which represent the most popular app use case among our respondent companies.

- Only about 11% of companies polled were working on any kind of hard physical product (such as a medical device). Nearly 90% of companies were selling software and apps without no physical product.

Below are a selection of responses to this question, taken directly from our survey:

Company Headquarter Locations

We were surprised to see the extreme prevalence of San Francisco as a headquarter location for medical AI startups. While Emerj is based in San Francisco, we did not restrict our outreach locally. Though we did not collect reasons or motivations for establish headquarters in one location over another, the density seems to reflect both the massive prevalence of venture money in the Bay Area, as well as the increasing concentration of young startups beginning their journey in San Francisco as opposed to “the valley” (Mountain View, Palo Alto, etc).

Company Headquarter Locations – Noteworthy Insights:

- Over 55% of companies polled were in the USA

- Over 55% of USA companies polled were in California

- Over 40% of California companies polled were based in San Francisco

“Who Do You Sell To?”

This section of the survey was multiple-choice and allowed respondents to provide more than one answer, assuming they sell to more than one “type” of customer. Some companies selected 3-4 types of customers, while others only sell to one customer type—the most common being “Hospitals and healthcare facilities”.

Who Do You Sell To? – Noteworthy Insights:

- Over 80% of the companies claim to be selling directly to hospitals and healthcare facilities

- “Pharma / biotech firms”, “Medical device companies”, and “Payers / Insurance Companies” are each targeted by about one-third of our companies

Healthcare’s Adoption

We wanted to determine the factors that help or hinder AI from being adopted widely in healthcare. It’s interesting to note the general prevalence (at least within the United States) of the need for proven ROI for healthcare AI adoption. This section was also multiple-choice, where the “phases” of adoption were pre-defined and respondents could choose only one response option.

Healthcare’s Adoption – Noteworthy Insights:

- Nearly 50% of US companies believe that the healthcare industry “needs to be convinced further of ROI from AI / ML investments”

- Behind “needs to be convinced of ROI,” the second most popular response among both US and international companies is that healthcare providers recognize the value, but lack the technical skills, to bring the applications to life

- The above two insights should be seen as the two most prominent “hinderances” to AI adoption

- Under 2% or respondents reported “over-exuberance”, or too much optimism, in the market

Difficulty in Selling AI Products into the Healthcare Industry

This graph is particularly robust and we advise readers to explore by toggling the visibility of various respondent segments. A key insight from this portion of our research is that “the need for case studies”, i.e. the lack of case study literature, is perceived to be the main hindrance for AI sales in the healthcare sector. With such a new field, salespeople are starved for evidence of a strong track record of results—both in regards to healthcare efficiency and patient outcomes—which (as with any new B2B sector) presents a chicken-and-egg problem for sellers.

These answers were provided in an open-ended “paragraph” format, and they were later sorted into the discreet categories you see above. It is important to note that some companies responded with as many as three main “sales challenges,” while others listed only one; others did not provide a clear enough answer to be included.

Difficulty in Selling AI Products into the Healthcare Industry – Noteworthy Insights:

- Over one-third of all the votes cast for “sales difficulties” could be categorized as a need for proven results or case studies, which was by far the most popular and pressing sales challenge across literally all of our respondent segments

- Other top concerns could be categorized into “general industry conservatism”, often with complaints about healthcare facilities as “stodgy”; “regulatory challenges”, HIPAA or otherwise; and “lack of AI and ML skill in client company”

Below are a selection of responses to this question, taken directly from our survey:

Benefits Most Likely to Get Customers to Buy AI Products

Numbers in parentheses represent x axis

Respondents to this question had to score each of a number of designated “buying factors” on a 1-5 scale, with one representing the least likely to influence a sale and five representing a strong ability to influence a sale. We recommend looking at this data by individual segment, as there are interesting differences between USA vs international respondents, CEO vs non-CEO respondents, etc.

Benefits Most Likely to Get Customers to Buy AI Products – Noteworthy Insights:

- “Improving Health Outcomes” was rated as the factor of highest importance in getting a customer to buy an AI product, rated a 4.2 on a 1-5 scale. “Saving money” was close behind with a 4.1 score (in retrospect, “Improved Care Quality” seemed closely related to “Improving Health Outcomes” and, were we to run this survey again, we would probably aim to make these categories more distinct).

- Notably, the CEOs interviewed ranked “saving money” as the most important driver of sales, while non-CEO executives and VPs considered “improving health outcomes” as significantly more important. Considering a CEO’s likely consistent interactions with clients, their perspective may be more valuable and indicative of what genuinely drives sales.

- “Saving time” ranked low as a consideration in closing sales for pre-revenue companies, but it was tied for most important sales factors by revenue companies (those currently making a profit). This seems to indicate that only in a real sales environment are companies realizing the huge importance in “saving time” for their desired customers.

Patient Outcomes Improved by AI Within 5-10 Years

Numbers in parentheses represent x-axis

This question was framed in an open-ended “paragraph” format, and answers were later sorted into the categories you see above. Differences between segments vary significantly in some cases.

Patient Outcomes Improved by AI Within 5-10 Years – Noteworthy Insights:

- “Decision support systems” was ranked as the most likely application to be improved by AI (for improving patient outcomes), with a 4.15 score on a 1-5 scale

- The largest disparity in responses between 3 (USA) to 4.1 (international) is around wearables / sensor data tech. This may indicate a pessimism around “wearables” in the USA that doesn’t exist in European markets

Specific Medical Conditions Likely to Be Improved by AI

Like the one before, this question was also framed in an open-ended “paragraph” format, with answers later sorted into the categories you see above. Many companies were unable to list a specific condition and instead gave a response relating only to their technology or to some unrelated trend. The graph above includes only those responses that related directly to a specific condition or a class of conditions that respondents believe to be bettered by the advent of AI tools in healthcare.

Specific Medical Conditions Likely to Be Improved by AI – Noteworthy Insights:

- “Chronic Conditions” was listed in nearly one-half of responses

- Of the specific conditions mentioned under “chronic conditions”, “diabetes” topped the list at nearly 30% of the mentions

- Though the graph above solely represents the breakdown of chronic conditions, it’s worth noting that “cancer” was listed in over one-third of responses

Below are a selection of responses to this question, taken directly from our survey:

Date for Ubiquitous Use of AI in Healthcare

This portion of the survey essentially asked respondents by what date they would expect AI to be used widely across most functions of healthcare, a reality that we are admittedly far from today. This question was framed in a totally open-ended format, without data options from which to choose. Given the number of possibilities in such an open-ended question, we were surprised to see a huge confluence of responses on the year 2025.

Date for Ubiquitous Use – Noteworthy Insights:

- Over 25% of respondents stated that they believe AI will be nearly ubiquitous in healthcare settings by 2025

- Over 50% of respondents believe that AI will be ubiquitous in healthcare by 2025

- The global average across all respondents was almost exactly 2030

A List of Participant Companies

We are grateful to have heard directly from so many innovative AI-in-healthcare firms; our research wouldn’t have been possible without their insight and participation. Below is a list of the companies featured in our AI in healthcarw consensus:

| AIME Inc | Enlitic | Lunit | SemVox GmbH |

| AntWorks Healthcare | Etyon Health | Maxwell MRI | Sensentia Inc. |

| Austral Biometrics | Faros Healthcare | Medasense Biometrics Ltd. | Sentrian, Inc. |

| BonTriage | Galaxy.AI | Mediktor | SigTuple Technologies Pvt Ltd |

| Cardiogram | Health& | MedyMatch Technology | Anonymous* |

| Catalia Health | HealthNextGen Technologies Inc. | Mendel.ai | Somatix |

| Cloud Pharmaceuticals | Hexoskin | MetiStream | Sussie Life Science |

| CloudMedx Inc | Hindsait, Inc. | Pathway Genomics | Techcyte |

| ContextVision AB | Holmusk | Pensiamo | UnaliWear |

| Corstem | Innovation Dx | Prenetics Limited | VUNO |

| CureMetrix | Insilico Medicine, Inc. | Proscia Inc | Whole Biome, Inc. |

| diagnostics.ai | Kaia Health Software GmbH | Qventus, Inc | XOresearch |

| doc.ai | Lark | Roam Analytics | Zephyr Health |

*Respondent wishes to remain anonymous

Related Interviews and AI Healthcare Guides

This study is the latest in what will be a long line of market research efforts in AI. We welcome your ideas for additional questions or topics in our future surveys. Please visit our “about” page for contact information.

In the meantime, healthcare executives might also gain useful insights and ideas from the machine learning healthcare resources listed below:

Healthcare AI Interviews:

- Investing in AI Healthcare Applications – and Why Doctors Don’t Want to Be Replaced (with Investor Steve Gullans)

- Five Year Trends in Medical AI Applications (with Dr. Cory Kidd)

- On Future of AI in Consumer Healthcare Interfaces (with Matteo Berlucchi)

Healthcare AI Guides: